How the Underused Housing Tax Can Affect You

As of January 1, 2022, the Canadian government implemented the Underused Housing Tax. This is an annual 1% tax on the ownership of vacant or underused housing. It primarily applies to non-resident, non-Canadian owners, but can apply to residents as well.

Who Has to Pay the Underused Housing Tax

Excluded owners of residential properties in Canada do not have to pay the Underused Housing Tax. They have no obligations or liabilities and include:

- Canadian citizens or permanent residents (unless specified below).

- Anyone that owns a residential property as a trustee of a mutual fund trust, real estate investment trust, or specified investment flow-through trust (SIFT) in the Canadian tax system.

- Canadian corporations that have shares listed on a Canadian stock exchange for Canadian income tax reasons.

- Registered charities for Canadian income tax purposes.

- Cooperative housing corporations for Canadian GST/HST reasons.

- Indigenous governing bodies or corporations fully owned by an Indigenous governing body.

Those who are not excluded are labeled as affected owner and have obligations to pay the tax. These affected owners include:

- Those who aren’t Canadian citizens or permanent residents.

- Canadian citizens or permanent residents that own a residential property as a trustee of a trust (and are not a personal representative of a deceased person).

- Anyone that owns a residential property as a partner from a partnership.

- Corporations that are incorporated outside Canada.

- Canadian corporations whos shares are not listed on a Canadian stock exchange for Canadian income tax reasons.

- Canadian corporations without share capital.

Obligations of Affected Owners

Affected owners must file an Underused Housing Tax return for every residential property that they own in Canada on December 31. The Underused Housing Tax must be paid, unless you have an exemption. Even if you have an exemption, an Underused Housing Tax return must still be filed.

For the affected owners of this tax, not filing when it’s due can cause you to owe a minimum penalty of $5,000 as an individual. If the affected owner is a corporation, the minimum penalty is $10,000.

Exemptions to the Underused Housing Tax

Exemptions Based on the Type of Owner

- Specified Canadian corporation

- Partner of a specified Canadian partnership

- Trustee of a specified Canadian trust

- New owner in the calendar year

- Deceased owner, co-owner, or personal representative of a deceased owner.

Exemptions Based on the Availability of the Residential Property

- Newly constructed

- Not suitable to be lived in year-round

- Seasonally inaccessible

- Uninhabitable for an amount of days due to a disaster, hazardous conditions, or renovation

Exemptions Based on the Occupant of the Residential Property

- Primary place of resident for you, your spouse, common law partner, or your child that is going to a designated learning institution

- At least 180 days in the calendar year are included in more than one qualifying occupancy periods for your ownership of the residential property

Exemptions Based on the Location and Use of the Residential Property

- Vacation properties that are located in an eligible area of Canada and are used by you, your spouse, or common-law partner for at least 28 days in the calendar year

What is a Qualifying Occupancy Period?

This is when at least one month in a calender year has one of the qualifying occupants with continuous occupancy of the residential property. The qualifying occupants include:

- Someone with a written contract who deals at arm’s length with you, your spouse, or common-law partner.

- A person that has a written contract and does not deal at arm’s length with you, your spouse, or your common-law partner and pays at least fair rent for the property.

- You, your spouse, or common-law partner that has a Canadian work permit.

- Your spouse, common-law partner, parent, or child that is a Canadian citizen or permanent resident.

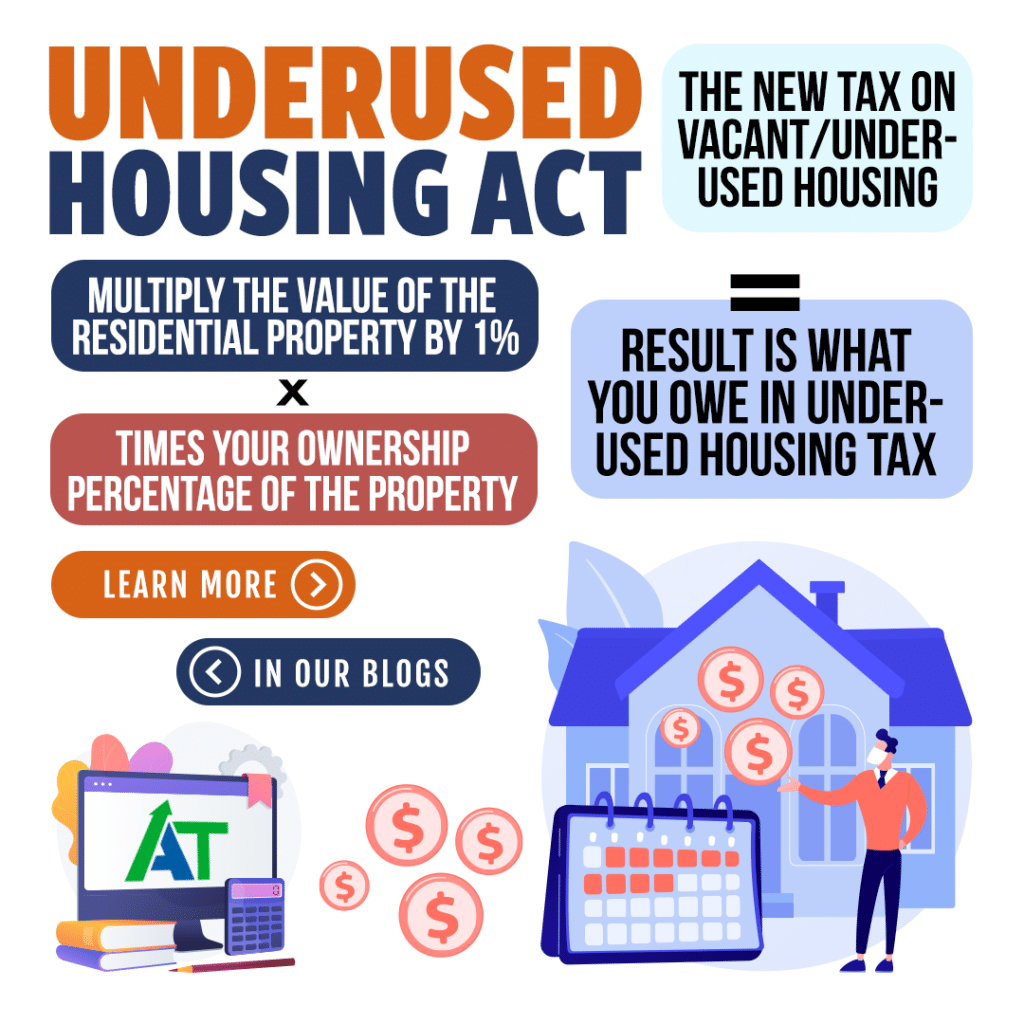

Calculating How Much Underused Housing Tax You Owe

The tax rate of the Underused Housing Tax is 1% and is based on the value of the residential property. If you qualify for an exemption as an affected owner, you still need to file but won’t pay the tax. Here’s how to calculate the taxes owed:

- Multiply the value of the residential property by the 1% tax rate.

- Multiply the result by your ownership percentage of the property.

Fair market value can be used as the value of the residential property instead of its taxable value, but an election must be filed.

This election would require an appraisal by an accredited, professional real estate appraiser who works at an arm’s length from the owner. For more information on this subject and more details on filing the your return for the Underused Housing Tax, check out the CRA’s page here.