Why Outsource Bookkeeping Services for Your Business

Maintaining financial records in-house becomes challenging for business owners. Some consider the option to outsource bookkeeping services to local or virtual bookkeepers. This helps the business address the challenge while giving time and opening other resources to focus on what you do best. Keep reading our blog to understand how, why, and when outsourced bookkeeping services can help your business succeed.

Why Outsource Bookkeeping Services?

Effectively managing your financial records lets your business stay prepared for tax obligations but also creates opportunities for insights on the business’ financial health. This can take a significant number of resources, depending on how much transactions occur in the business but either way, that’s time taken from concentrating on other aspects of operating the business. This can include growth opportunities or even time to yourself!

A professional bookkeeper enables the business to have up-to-date financial reports. These range from balance sheets, income statements, and cash flow statements, all helping the business make informed decisions. Additionally, it streamlines the tax filing process, ensuring the reports are accurate and ready on time for the CRA’s deadlines.

When to Outsource Bookkeeping Services

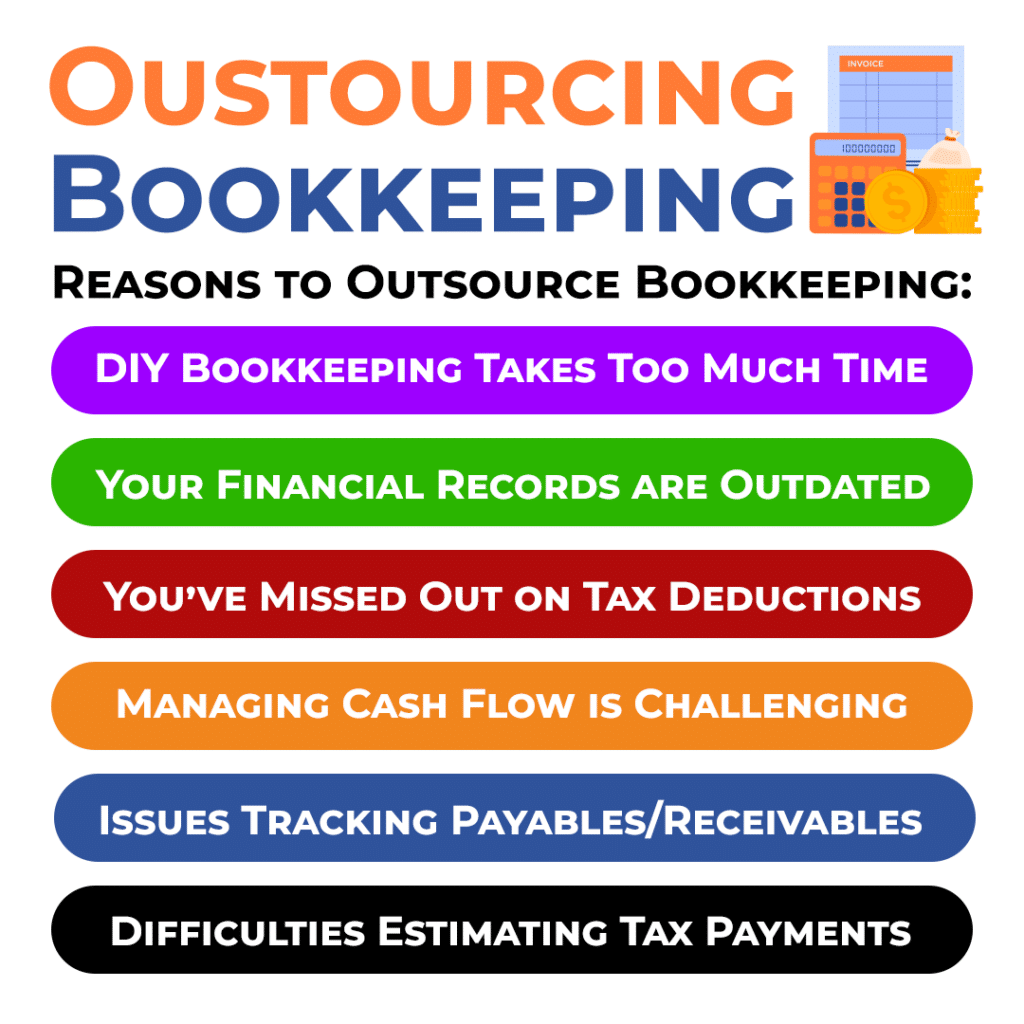

If any of the following situations apply to your business, it is important to outsource your bookkeeping services. Making this decision depends on whether:

- DIY bookkeeping consumes too much time.

- Your financial records are outdated.

- You miss out on tax deductions.

- Managing cash flow is challenging.

- Tracking accounts receivable and payable is problematic.

- Estimating tax payments are stressful.

If any of the above situations apply to your business, outsourcing your bookkeeping services may just be what you need. Outsourcing your bookkeeping too late can leave the business with consequences through inconsistent record-keeping and obstacles in scaling.

Types of Outsourced Bookkeeping Services

There are two main ways to outsource your bookkeeping. The first is to hire a local bookkeeper, while the other method would be to hire virtual bookkeeping services.

Local Bookkeepers

If you prefer face-to-face interaction and manage your business’ financial records through physical documents, this is the ideal way to outsource your bookkeeping. It can be done through either of the two main types, freelancers and firms.

- Freelancer: Works directly with you, either online or in-person, providing flexible services tailored to your needs.

- Firm: Typically, more expensive than freelancers but offer certified professionals and continuity of service.

Virtual Bookkeeping

Virtual Bookeeping services small business work for you if you’re comfortable with online banking and prefer meeting digitally. It combines traditional bookkeeping with online software so that you always have real-time access to financial data. Some benefits include:

- Flat Monthly Rates: Consistent costs compared to hourly billing.

- Online Access: Secure, real-time access to financial records through mobile apps or web platforms.

- Cloud Storage: Safe and accessible storage of financial data.

Services by accounting firms connect you with professional bookkeepers who manage your books and provide tax-ready financial statements each month, allowing you to track finances and communicate with your team effortlessly.

Struggling with Your Bookkeeping?

Get in touch with our team, we’ll help take care of it for you.

In-House Bookkeeping

When a business has a more complex bookkeeping system or needs bookkeeping to be done in coordination with the operations, hiring an in-house bookkeeper may be a better option. It generally costs more than outsourcing and an annual salary for a full-time bookkeeper in Canada costs an average of $53,679 per year. Keep in mind, this doesn’t consider any other benefits offered, training costs, and other HR or management needs. Alternatively, a part-time bookkeeper can be hired, or the bookkeeping and administrative roles can be combined.

Should Your Business Outsource Bookkeeping Services?

Based on your business strategy, making the decision to outsource bookkeeping services can save time, reduce stress, and provide accurate insights to your finances. Each business has unique needs that work better with either local, virtual, or in-house bookkeeping solutions. Talking to a CPA can help you make that decision, especially when considering any business’ tax, bookkeeping, and accounting needs.

If you’re unsure of what to do, reach out to our team to find out what financial systems and processes are best for your situation. We’ll give your business the support it needs so that you can focus on growing the business and achieving your goals.