Here’s What You Need to Know About the New Trust Reporting Requirements for T3 Returns

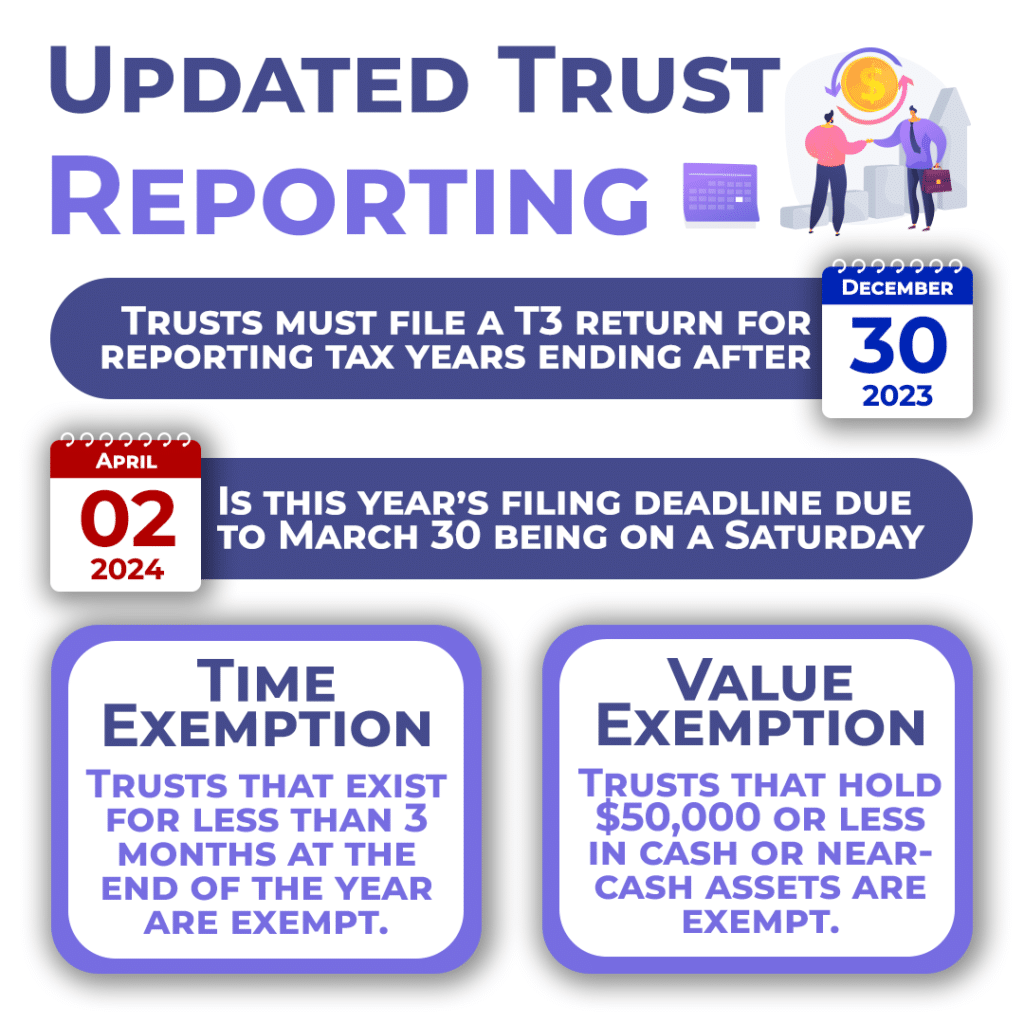

The Canada Revenue Agency just made a major announcement in that all trusts, with a few exceptions, must file a T3 return. This is required for trust reporting in tax years ending after December 30, 2023. For certain trusts like bare trusts, this will be the first time that they need to file.

Which Trusts Need to File a T3 Return

Any trust, either resident or non-resident, need to file a T3 return if the meet the following criteria:

- They have tax payable.

- There is a request to file.

- It is a deemed resident trust.

- The trust has disposed of a capital property. Alternatively, if they have a taxable capital gain, they need to file as well.

- Holds property that relates to subsection 75 (2) of the Income Tax Act.

- The trust provided a benefit of over $100 to a beneficiary for upkeep, maintenance, or taxes for property maintained for the beneficiary to use.

- It receives income, gains, or profits from the trust property that is allocated to beneficiaries. On top of that, the trust has done the following:

- The total income is over $500.

- Income more than $100 is allocated to any single beneficiary.

- Has made a distribution of capital to any beneficiaries.

- It has allocated any part of the income to a non-resident beneficiary.

Bare Trusts

The new changes have a significant effect on bare trusts. A bare trust is when the trust acts as an agent for its beneficiaries. The person or entity that is listed as the owner of an asset does so for another and is not the true beneficial owner.

First, it is important to understand if a bare trust arrangement even exists. To do so, the title or asset holder’s benefits and costs or risks are compared to find a mismatch. If there is one between legal and beneficial ownership, it is likely a bare trust and needs a return. In a bare trust arrangement, it is likely that a lawyer was not involved and there is no written agreement. Here are some common examples:

- When a parent is on the title of a child’s home and they don’t have beneficial ownership, while helping the child in getting a mortgage, this is considered a bare trust.

- In the case where spouse is on the title of a house while the other spouse is a partial beneficial owner, it is a bare trust.

- If a corporation is on the title of an individual’s asset or vice versa, this is another case in which there is a bare trust arrangement.

Exemptions to the New Trust Reporting

Registered plans, qualified disability trusts, and those falling under the following criteria are exempt to the new trust reporting changes.

- If the trust has been in existence for less than three months at the end of the year, they are exempt.

- When a trust holds $50,000 or less in cash or designated near-cash assets in the year, they are exempt.

- Certain estates are exempt as well.

Trust Reporting for the First Time

If the trust is affected by these changes, that means a T3 Trust Income Tax and Information, or T3 Return and a Schedule 15 Beneficial Ownership Information of a Trust need to be filed with the CRA annually. The change is that if a trust didn’t earn any income, dispose of any capital property, or distribute income or capital in the year would generally not have to file an annual return.

Not Sure if You Need to File a Trust Return?

Get in touch with our expert accountants today.

What Does Your Trust Need to Do and When

If the trust is affected, that means they need to be filing an annual T3 return for tax years ending after December 30, 2023. Deadlines for a T3 return and the Schedule 15 are 90 days after the trust’s tax year end. Most of the time, the tax year end is the calendar year end. For any trusts that had a December 31, 2023, tax year end, they need to file by March 30, 2024. This is a Saturday, so the return is deemed filed on time if the CRA receives it on the next business day. For 2024, that means the deadline moves to April 2, 2024.

To get started on the filing, additional information for all reportable entities is needed. This includes trustees, settlors, beneficiaries, and controlling people for the trust. The controlling people include any of those who could have been a reportable entity for only part of the year.

Another piece of information needed is the trust account number. For any correspondence, payments, and the return itself, make sure the trust number is included. If you don’t have the trust number yet, the CRA has online options to do so in the following forms:

- My Account

- Access it from the “More Services” option.

- My Business Account

- Access it from the “Open New Account” option.

- Represent a Client

- Access it from the main menu.

Need Help with Trust Reporting?

Make sure you’re prepared for the filing deadline of April 2, 2024, if you need to file a T3 trust return this year. Our team of tax experts is here for you so send us a message or give us a call to help you get through this process, especially if it’s your first time filing a trust return. If you’re not clear on whether you’re in a bare trust or not, well that’s just another reason to get in touch with a professional tax consultant. Get ahead of the tax season today by reaching out to us here.