Our Guide on How to Get a GST Number in Canada

For businesses in Canada who are coming to or have passed the $30,000 annual revenue mark, they must consider that they need to register for a GST (Goods and Services Tax) number. In this guide, we’ll take you through the steps on how to get a GST number in Canada. Your GST number is a key part of the process for any business to collect and pay GST on their sales while claiming the GST from their expenses.

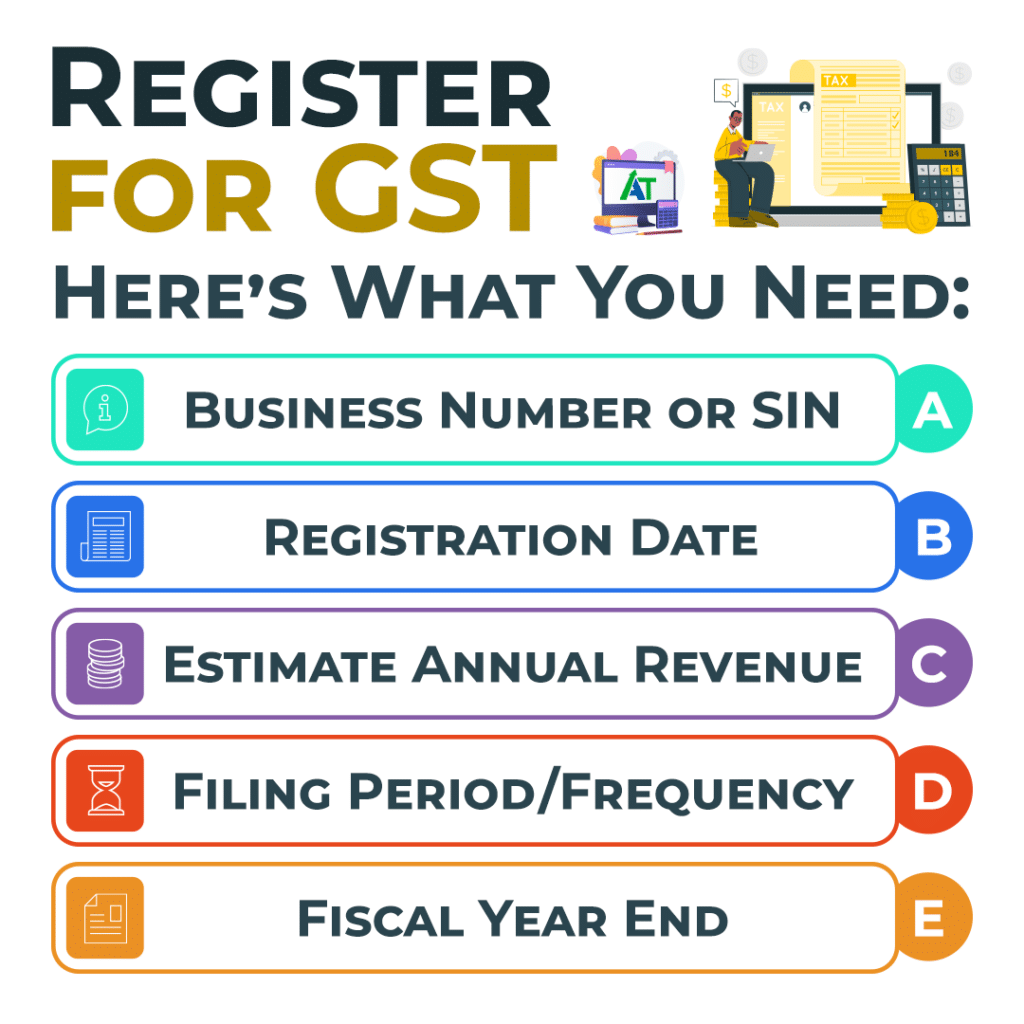

Business Number (BN) or Social Insurance Number (SIN): The Initial Step to Get a GST Number

Before starting the GST registration process, make sure you have either a Business Number (BN) or a Social Insurance Number (SIN). If you don’t have a BN yet, you can use your SIN instead. We recommend getting a BN for easier access to other tax programs that may apply to your business like the following:

- GST/HST program account (RT)

- payroll deductions program account (RP)

- import-export program account (RM)

- corporation income tax program account (RC)

Find out more about how to get yourself a Business Number through the CRA’s website by clicking here.

Not Sure How to Get a Business or GST Number?

Speak to our accountants today to make the process as smooth as possible.

Selecting the Registration Start Date: Backdating GST Registration

Choosing the right date for your GST registration is important. Usually, this is the date when your annual revenue reached and/or exceeded $30,000. At this point in revenue, it becomes mandatory to register for a GST number in Canada. You may even want to consider backdating GST registration for a sole proprietorship, depending on when you hit the revenue threshold. If you have questions on what to do if you need to back date GST registration, just contact us.

Estimating Annual Revenue: A Critical Component to Get a GST Number

To finish the registration process, you’ll need to provide an estimate of your annual revenue. This includes taxable sales, leases, and other supplies, but excludes supplies that are exempt, financial services, and certain property sales. Part of our accounting services include helping you accurately estimate your annual revenue for GST registration. Keep in mind, this estimate doesn’t need to be exact, but do the best you can because it determines your filing period and frequency. This ranges from quarterly to annually depending on your revenue and preferences.

Choosing Your Fiscal Year End Based on Your Business Structure

Generally, sole proprietors and people considered to be self-employed choose a fiscal year that aligns with the calendar year. This makes it easier considering that the income tax year lines up accordingly. Corporations may have a different fiscal year that doesn’t align with the tax year and can be any 365-day period in the year. Depending on your business structure, you’ll want to choose a fiscal year that works best for your unique business.

Methods of Registering for a GST Number in Canada

Here is a brief list on the methods used when registering for a GST number in Canada:

- Online Registration: This is the fastest and most efficient method. Using the Business Registration Online (BRO) service streamlines the registration process and can be done by clicking here. For non-resident businesses, check out the CRA’s Guide RC4027, “Doing Business in Canada – GST/HST Information for Non-Residents”.

- By Mail or Fax: If you prefer a more traditional method, use the form RC1. This form is used to “Request for a Business Number and Certain Program Accounts” and can be completed and submitted to by mail or fax.

- By Phone: Businesses can call the business enquiries line at 1-800-959-5525 to register for a BN and other CRA program accounts, including the GST account.

Start registering for your GST number using the CRA’s platform by clicking here.

Obtaining a GST number in Canada is an important step for businesses. Having a reliable CPA accounting firm by your side makes the process and filing much simpler. Plan your registration in consideration of your revenue, choose an appropriate fiscal year end, and provide a revenue estimate. If you have questions or need assistance, our team at Advanced Tax is here to help. All you need to do is reach out to us by clicking here. Get your GST number in Canada with confidence, while making sure that your business is compliant with the Canada Revenue Agency.