How Does the RRSP Tax Deduction Work for Canadian Income Tax

Setting up an RRSP, or Registered Retirement Savings Plan, not only assists you in retirement at ensuring you have the savings you need, but also provides an RRSP tax deduction based on the amount you contribute. You set up the account and it is registered with the government so that you or your spouse/common-law partner can contribute to it for tax deductions.

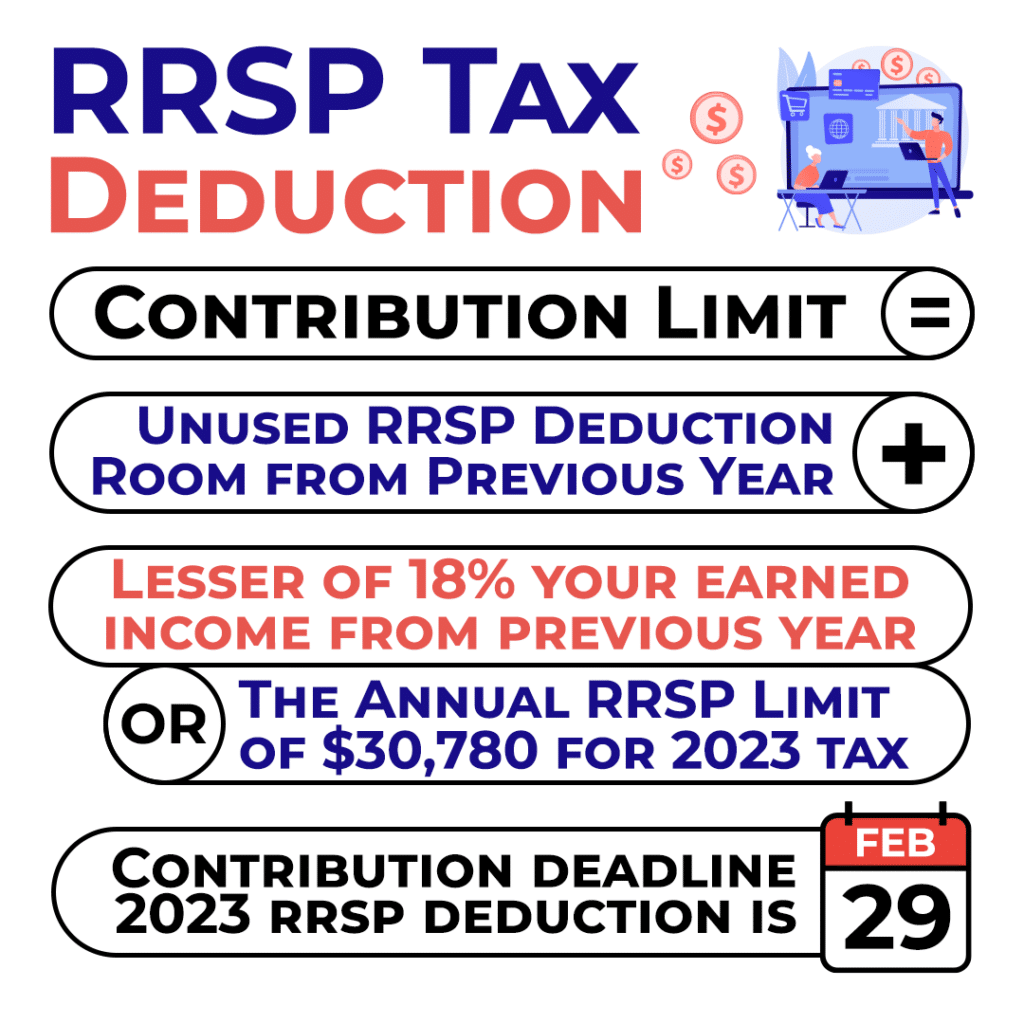

After the end of a tax year, Canadian taxpayers are given two extra months to contribute to their RRSP. The RRSP contribution deadline is at the end of February after every calendar year. In 2024, this falls on Thursday, February 29.

Setting Up Your RRSP

RRSP accounts are set up through financial institutions. The income generated in your RRSP investment account is exempt from tax until you begin to receive payments from the plan. Depending on your financial situation, your financial institution will recommend different types of RRSP accounts and potential investments.

Alternatively, a spousal or common-law partner RRSP can be set up. This ensures that your retirement income is split more evenly. Usually, this has benefits when there are differences in income levels between the partners. The contributor gets the tax deduction for their contributions and the annuitant receives the income. It is likely that the annuitant, or whoever is receiving the payments in retirement, will be of a lower income tax bracket. Thus, they would pay less tax on it the funds received.

Types of RRSP Investments

A self-directed RRSP is one in which you build and manage your own investment portfolio. It involves buying and selling a variety of different types of investments. On the other hand, you can rely on your financial institution instead to build and manage a mixed investment account of mutual funds, bonds, GICS, equity (stocks) or other plans catered to your financial needs and risk levels.

Annual RRSP Tax Deduction Limits

When making contributions to your RRSP, it is important to consider your RRSP deduction limit. Even though 100% of your RRSP is tax deductible, there are limits and penalties for those who contribute more than their allowable limit. Every dollar that is contributed reduces your taxable income by the same amount.

You can contribute to your RRSP until December 31st of the year that your turn 71 if you have an available RRSP deduction limit. For a spousal or common-law partner RRSP, the same applies but is dependent on when they turn 71 and not you. Keep in mind that any amount paid for administration services for an RRSP can’t be claimed. Only claim the amount that is contributed directly to the RRSP.

Not Sure How to Claim Your RRSP Deduction?

Call our tax experts and get to the bottom of maximizing your tax savings.

Calculating Your Maximum RRSP Tax Deduction

Your RRSP deduction limit contains the following amounts:

- Your unused RRSP deduction room at the end of the previous year.

- The lesser of either 18% of your earned income in the previous year or the annual RRSP limit.

- For 2023, the annual RRSP limit is $30.780.

If you are unsure of what your RRSP deduction limit is, check your latest notice of assessment, notice of reassessment, or Form T1028 and it will show your RRSP deduction limit.

You can also view your RRSP information online via the CRA’s My Account portal. Find your deduction limit by clicking here.

Exceeding Your RRSP Tax Deduction Limit

If you contributed more to your RRSP than what was allowed in your RRSP deduction limit, you may have to pay a penalty. This is a tax of 1% per month on unused contributions that exceed your RRSP deduction limit by over $2,000. There are some situations in which the penalty doesn’t apply, and they are as follows:

- The excess amount was withdrawn by the end of the month in which the contribution was made.

- The contributions were qualifying group plan amounts.

- The contributions were made before February 27, 1995.

Withdrawing Funds from Your RRSP

While the funds remain in your RRSP, the income they earn is tax exempt. Once any withdrawals are made, payments are received, or an investment is cashed in, then tax is paid. For locked-in RRSPs, funds generally cannot be withdrawn until retirement.

The Home Buyers’ Plan (HBP)

This is a program by the federal government that lets you withdraw funds from your RRSP to buy or build a home for yourself or disabled person. The current HBP withdrawal limit is $25,000. For each withdrawal under the HBP, a Form T1036, Home Buyers’ Plan (HBP) Request to Withdraw Funds from an RRSP needs to be filled out.

Meeting the Annual Contribution Deadline for the RRSP Tax Deduction

The deadline to contribute to your RRSP for the deduction to apply on your 2023 income tax return is on February 29, 2024. It is always the last day of the February after the end of the tax year. You may still be unsure of how much you can contribute and what the best way to maximize your tax savings is. That’s what our team of tax experts is here for. Get in touch with us for a free consultation with our accountants by clicking here. We can help you identify how much you should deduct and work with you to plan your next year’s taxes.