A Guide to the BC Renter’s Tax Credit

You may have heard of the BC Renter’s Tax Credit, but we’re here to break down exactly how it works. That means discussing what it is, who is eligible, how to claim it, and how much you get. Between increasing living costs and general inflation, the government understands that British Columbians are struggling to keep up. To help the residents of British Columbia, the provincial government employed this refundable tax credit.

What is the BC Renter’s Tax Credit?

During the 2023 tax year, the BC Renter’s Tax Credit was introduced to offer financial assistance to low and moderate-income residents. These residents must be renting an eligible rental unit, basically almost any living accommodation in British Columbia. It is processed by the Canada Revenue Agency (CRA) for BC through your personal income tax return.

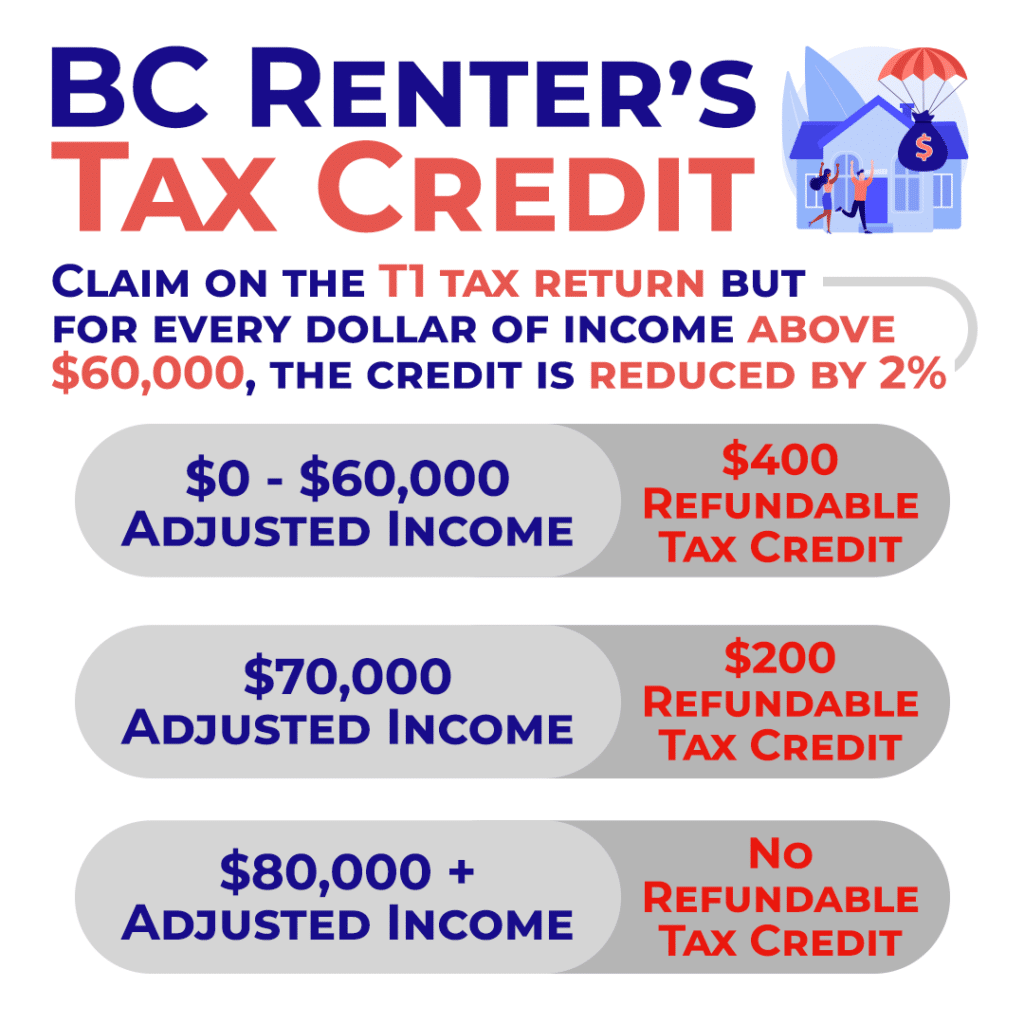

How Much is the Credit Amount?

Depending on the individual’s adjusted income, the amount of the BC Renter’s Tax Credit varies. For the 2023 tax year, the maximum credit is 0. To receive this maximum credit, the individual or family’s adjusted income should be $60,000 or less. The credit is phased out as the adjusted income increases until $80,000. This reduction is based on 2% of the amount by which your 2023 adjusted income is more than $60,000. Additionally, the income threshold amount is indexed to inflation every year. For example, in 2024, the thresholds will be from $0 to $63,000 for the maximum credit, and it’ll be phased out at $83,000.

Eligibility Criteria

To qualify for the BC Renter’s Tax Credit, individuals must live in an eligible rental unit in BC for at least six one-month periods during the tax year, pay rent for the unit, and be a BC resident on December 31st of the tax year. Additionally, individuals must be 19 years or older, a parent, or cohabiting with a spouse or common-law partner.

Here’s an Easier Way to Find Out if You’re Eligible

Just get in touch with our tax experts today and get the info you need.

Eligible Rental Units

Rent must be paid on an eligible rental unit which includes the following:

- Single-family dwellings

- Apartments

- Condominiums

- Townhouses

- Basement Suites

- Detached Suites

- Carriage Houses

- Co-operative housing

- College and university dormitories

- Long-term care facilities

- Shared housing (roommates)

- Subsidized housing

- Employer-owned accommodation

- In this case, rent must be either paid to the employer or deducted from the employee’s pay. It must be rented and occupied month to month.

Ineligible Situations

If any one of the following situations apply to you, you cannot claim the BC Renter’s Tax Credit.

- You are living with your spouse or common-law partner who has already claimed the credit for the tax year.

- On December 31 of the tax year, you were confined to a prison or similar institution. During the year, the confinement lasted a total of more than 6 months in the year.

- You were an employee of a foreign country or lived with a family member of a foreign country in Canada.

- If the individual passed away before the end of the tax year, they are not eligible.

- It is proposed that during an in-bankruptcy income tax return from going bankrupt in the tax year, you cannot claim the tax credit.

Ineligible Rent

The following amounts paid are not eligible for the BC Renter’s Tax Credit:

- Rent paid to a non-arm’s length landlord. This includes parents, siblings, or relatives.

- Payments under a rent-to-own plan.

- Employer-provided accommodation that you do not pay for, is not deducted from your pay, and is not included as a taxable benefit in your income.

- Payments for a campsite, moorage, or manufactured home site like a mobile home or trailer park pad.

Claiming the BC Renter’s Tax Credit

Claiming the BC Renter’s Tax Credit is a straightforward process. Individuals claim it by completing the BC479 form for British Columbia Credits during their personal income tax failing. To make sure there are no discrepancies or delays in claiming the BC Renter’s Tax Credit, fill out the appropriate form on your T1 Income Tax and Benefit Return.

How You Can Make the Most of the BC Renter’s Tax Credit

This tax credit is a major opportunity for those struggling with increased living costs in British Columbia. Because it is a refundable tax credit, it will reduce the taxes you owe and if the credit is more than the combined federal and BC income tax you owe, the difference will be paid out as an income tax refund. Work with our tax experts to make sure you make the most of the BC Renter’s Tax Credit today. Contact them and book your appointment to get your personal income tax filed for the last tax year by clicking here.