A Comprehensive Guide to the FHSA in Canadian Tax Returns

The First Home Savings Account or FHSA is a tax-free savings plan. It is a registered account for first-time homebuyers to gather funds to buy or build their qualifying first home. It is important to understand how this account can affect your tax return to plan your taxes efficiently. Benefits from the FHSA for tax returns come with rules around contributions, withdrawals, transfers, and reporting requirements. There are tax-deductible contributions and tax-free withdrawals for qualifying home purchases, so you’ll want to make sure you’re maximizing it.

The Process to Open Your FHSA

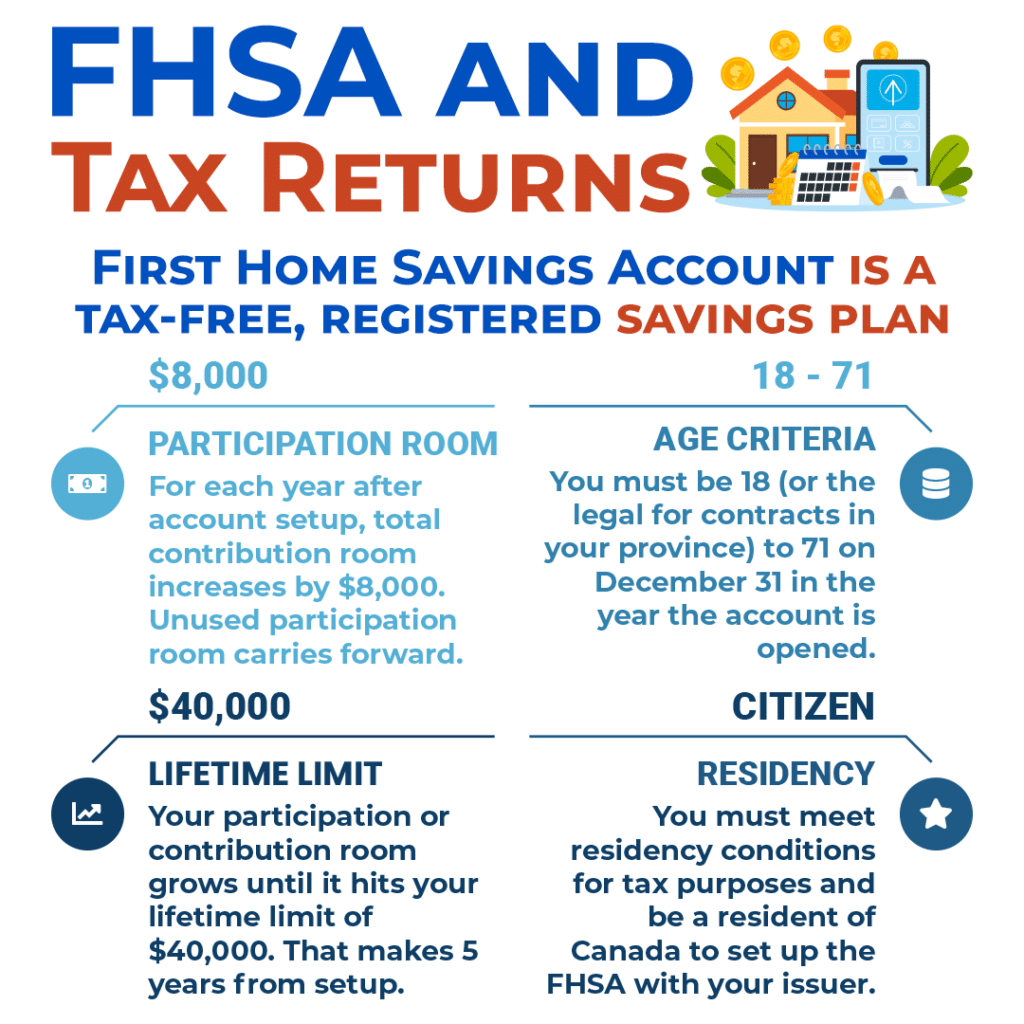

To set up your First Home Savings Account, you need to meet the following criteria:

- You must be 18 years or older.

- Alternatively, you need to be the legal age for contracts in provinces that are not set at 18.

- Your age must be 71 or younger as of December 31 of the opening year.

- You must meet residency conditions and be a resident of Canada.

The information your FHSA issuer will need includes your Social Insurance Number (SIN), date of birth, and certification of your eligibility as a first-time homebuyer. If any information submitted around your eligibility is inaccurate, the account can be revoked on top of significant tax implications.

Types of FHSA Accounts

Depending on your investment preference, your First Home Savings Account investment can take different forms. Depositary FHSAs provide stable growth through cash, term deposits, or Guaranteed Investment Certificates (GICs). Trusteed FHSAs offer growth potential with investments like bonds and mutual funds. Insured FHSAs provide additional security through annuity contracts, usually providing even more peace of mind for these investors.

Your FHSA Participation Room

The First Home Savings Account participation room refers to the maximum amount you can contribute or transfer to it. In short, for every year since opening the account, your participation room grows by $8,000. In the first year of opening your First Home Savings Account, your participation room is set at $8,000 and keeps growing until the lifetime limit of $40,000. Unused contribution room carries forward and your FHSA participation room equals the total unused amounts from previous years, plus $8,000 for the year.

Excess Contributions

Exceeding your FHSA contribution or participation limit results in creating an excess FHSA amount. If your participation room for the year minus the total contributions or transfer is a negative amount, you have an excess FHSA amount. This incurs a tax of 1% per month on the highest excess FHSA amount in that month. This payment continues until the excess amount is removed by new participation room on January 1 of the next year, or by removing the amounts yourself. In the case where the calendar year ends and you have an excess FHSA amount, you need to file a return to report it and determine the tax payable.

Withdrawals from the FHSA

To make tax-free withdrawals from your First Home Savings Account, there are a few conditions to meet. These conditions include the following:

- You are a first-time home buyer for the withdrawal. This means that you did not live in a qualifying home in Canada that you owned or jointly owned at any time in the current calendar year before the withdrawal. There is an exception to the 30 days right before the withdrawal or the 4 previous calendar years.

- The next condition is needing a written agreement to buy or build the qualifying home. The acquisition or construction completion date needs to be before October 1 of the year after the date of the withdrawal.

- You must not have acquired the home more than 30 days before the withdrawal.

- You must be a resident of Canada from the time of the first qualifying withdrawal from an FHSA until the earlier of the following situations:

- The acquisition of the qualifying home.

- The date of your death.

- The qualifying home needs to be your principal place of residence in one year after buying or building it.

- You need to fill out Form RC725, Request to Make a Qualifying Withdrawal from your FHSA and then give it to your First Home Savings Account issuer.

You need to meet all the above conditions to make a tax-free withdrawal. If you do not, then your withdrawal is not qualified and may be taxable. This requires you to include it as income on your income tax return for the year in which the withdrawal was received.

What’s a Qualifying Home

To be considered a qualifying home, it must be a housing unit in Canada including existing homes and homes under construction. This includes single-family homes, semi-detached homes, townhouses, mobile homes, condominium units, apartments in duplexes, triplexes, fourplexes, or apartment buildings, or a share in a co-operative housing corporation that lets you own and gives an equity interest in a housing unit. When the share only gives you a right to tenancy in the housing unit, it does not qualify.

Designated Withdrawals for Excess Amounts

To reduce or eliminate an excess FHSA amount, you can:

- Make a withdrawal of a designated amount. This withdrawal must be equal to or less than the excess FHSA amount and requires filling out Form RC727.

- Make a direct transfer of a designated amount from your FSA to your RRSP or RRIF.

- Making a taxable withdrawal from your FHSA.

- Any amounts are included as part of income if the account loses its status as an FHSA.

Reporting and Documentation

When utilizing the First Home Savings Account, it is crucial to file your income tax returns on time. FHSA activity in the year needs to be reported, but First Home Savings Account issuers will send a T4FHSA statement. This tax slip has all the information your accountant will need. This includes details on contributions, transfers, and withdrawals so that your tax return filing is accurate.

To really leverage the benefits of your First Home Savings Account in tax returns, you need to make sure you understand the rules it comes with. In certain cases, it may just be best to get in touch with a personal tax expert so that you don’t end up paying more tax than you need to. Reach out to the Advanced Tax team today to get ahead of your tax planning with a personalized solution. If you already have your account setup, we’ll make sure you get the expert guidance needed to complete your FHSA tax return with confidence.