Filing an Appeal to the Tax Court of Canada

If in the case that an income tax or GST dispute needs to be resolved, first send a notice of objection to the Canada Revenue Agency (CRA). They will review the notice and attempt to resolve it with a reassessment, confirmation or redetermination. At this point, if you still do not agree with the decision made by the CRA, you can appeal to the Tax Court of Canada.

The Tax Court of Canada is independent as a court of law and conducts regular hearings across Canada. There are two distinct procedures that appeals are heard through and more information can be found on the Tax Court of Canada‘s website.

Time Limit to Appeal to the Tax Court of Canada

When you get the notice of confirmation, reassessment or redetermination from the CRA, there is a 90 day time limit to file an appeal to the Tax Court of Canada. Alternatively, if the Canada Revenue Agency has not issued a decision within 90 days from the filing of the income tax objection or 180 days from the GST/HST objection, you can still file an appeal.

COVID-19 brought forth the Time Limits and Other Periods Act which allowed for the temporary extensions to some of the cases which exceed the regular appeal deadlines.

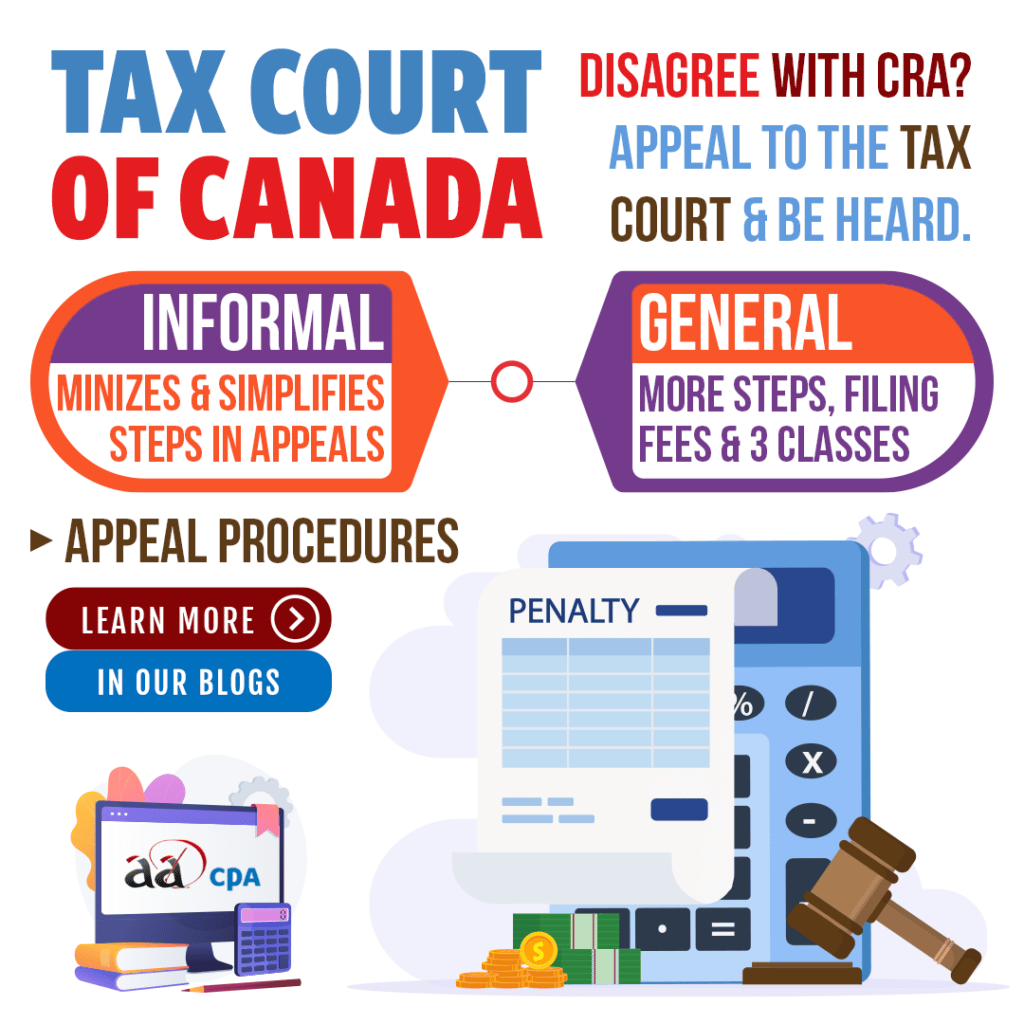

Procedures in the Tax Court of Canada

Informal Procedure

The informal procedure minimizes and simplifies the legal steps in an appeal process. There are no filing fees and applies to those appeals in the Tax Court of Canada under the Income Tax Act as well as the Excise Tax Act.

When considering income tax appeals, the Informal Procedure is limited to cases in which amounts of federal tax and penalties in dispute for each taxation year excluding interest is ,000 or less. Other than that, it applies to cases where the loss in question is $50,000 or less regarding GST appeals.

Even if the amounts in the objection exceed the limitations but the tax payer filing the appeal wants to go ahead with the informal procedure, this is still possible. They must state it in the Notice of Appeal that there is an agreement to limiting the appeal to either $25,000 or $50,000.

3 Classes in the General Procedure

Class A

- Amount in issue is less than $50,000

- Appeals in which amount of loss is determined to be less than $100,000

- Filing fee is $250

Class B

- Amount in issue is between $50,000 and $150,000

- Appeals in which amount of loss is determined to be between $100,000 and $300,000

- Filing fee is $400

Class C

- Amount in issue is more than $150,000

- Appeals in which amount of loss is determined to be more than $300,000

- Filing fee is $550

When appealing through the General Procedure to the Tax Court of Canada, it is possible to represent yourself or be represented by a lawyer. Corporations must be represented by a lawyer.

How to File an Appeal to the Tax Court of Canada

To start filing your appeal, mail or deliver your Notice of Appeal to a Tax Court of Canada Office or send it by fax. Additionally, it is possible to use the Tax Court of Canada’s Electronic Filing and is available through their website.

Missing a deadline to file an appeal requires an application to the Tax Court of Canada for an extension of time to appeal. Regarding income tax and GST/HST appeals, you have one year and 90 days to apply. This is from the date of confirmation, reassessment or redetermination by the CRA. To qualify for the extension, it must be demonstrated that:

- You could not appeal or have someone else appeal for you within the appeal period.

- You intended to appeal within the appeal period.

- It is fair to grant the application.

- You applied as soon as you could.

- There are reasonable grounds for appealing.

To find out more information, check out the CRA’s page on Filing an Appeal to the Tax Court of Canada by clicking the link here.