CCB: Our Guide to the Canada Child Care Benefit

What is Canada’s Child Care Benefit?

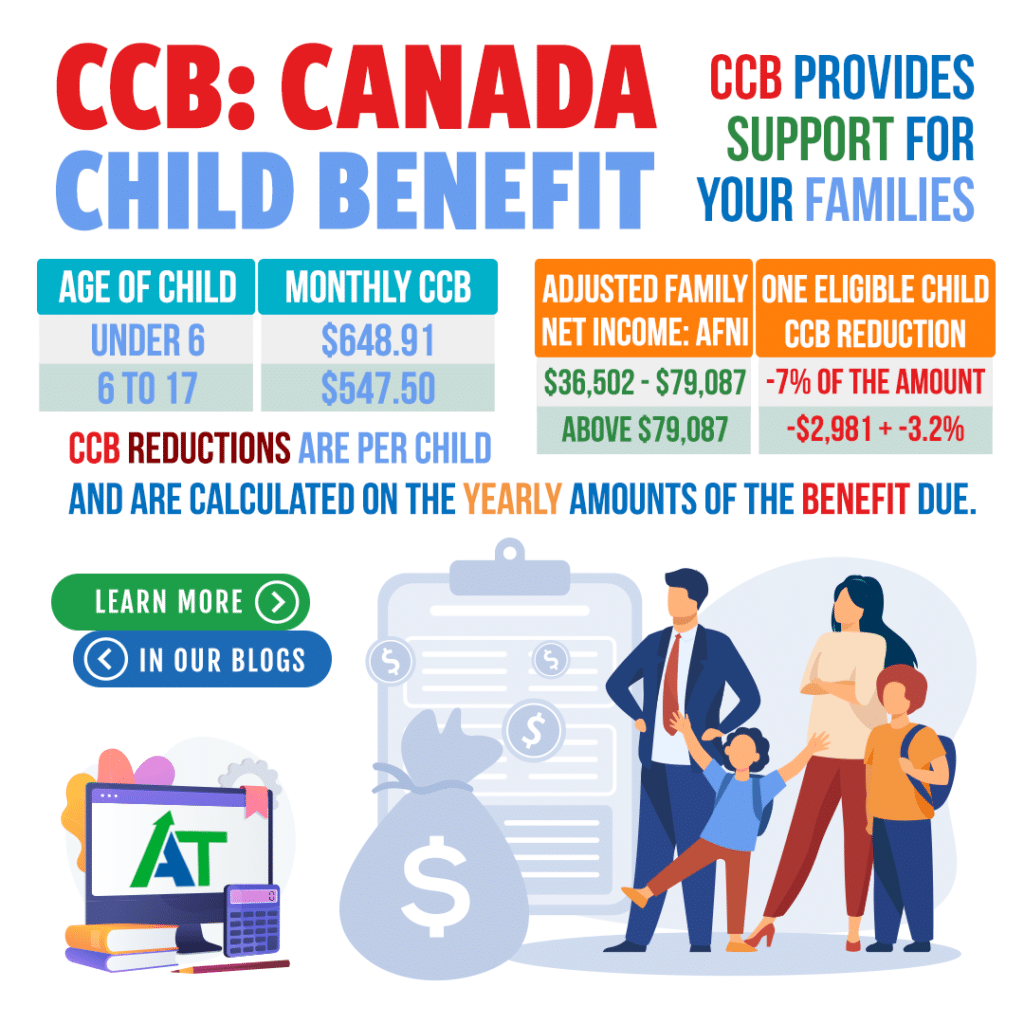

The Canada Child Care Benefit (CCB) program provides crucial financial support to families across Canada, offering monthly payments to help ease the cost of raising children. Receiving child care benefits is determined by several key factors, including your family’s adjusted net income from the previous year’s tax return, the number of children in your care, and their ages.

It is a non-taxable amount that is paid monthly for families with children under the age of 18. On top of that, there is a Child Disability Benefit which certain families may be eligible for but both are based on your adjusted net income. The adjusted net income is calculated by dividing the total family income by any government income support, such as the Universal Child Care Benefit (UCCB) and the Registered Disability Savings Plan (RDSP). This is compared to determine whether your income meets the CRA criteria for federal CCB.

For example, families with a net adjusted income below $36,502 may qualify for the maximum benefit of $648.91 monthly or $7,787 annually. The benefit decreases as family income increases to ensure federal funding provides financial aid for those in need. To explore eligibility and income thresholds, visit the Canada Revenue Agency (CRA)’s website.

When you apply for the Canada Child Benefit, your children are also registered for the goods and services tax or harmonized sales tax (GST/HST) credit, climate action incentive payment (CAIP), and any other related federal, provincial and territorial programs that the CRA offers alongside it.

Eligibility for the Canada Child Benefit

- You must be living with the child.

- They must be under 18 years of age.

- You must be primarily responsible for the child’s care and upbringing.

- You must be a resident of Canada for tax purposes.

- You or your spouse (or common-law partner) must be:

- A Canadian Citizen

- A Permanent Resident

- A Protected Person

- A Temporary Resident

- This means you have lived in Canada throughout the last 18 months and have a valid permit in the 19th month.

- Registered or Entitled to Register Under the Indian Act

Ideally, you should apply when your child is born, begins to live with you or when a new shared custody arrangement begins.

Calculating the CCB Amount

The calculation of your CCB amount is based on:

- Number of Eligible Children

- Ages of Eligible Children

- Adjust Family Net Income (AFNI) for the Last Tax Year

- Eligibility for the Disability Tax Credit (DTC)

The CCB is currently calculated as:

- $7,787 per year for each eligible child under the age of 6.

- This translates to $648.91 per month.

- $6,570 per year for each eligible child aged 6 to 17.

- This comes to $547.50 per month.

CCB Calculations per Each Additional Child

If your AFNI is less than $36,502 and you have at least one child, the payment will be of the maximum amount and is not reduced.

One Eligible Child

- The reduction is 7% of the amount of the Adjusted Family Net Income (AFNI) greater than $36,502 up to $79,087.

- If income is greater than $79,087 then the reduction is $2,981 plus 3.2% of the AFNI greater than $79,087.

Two Eligible Children

- The reduction is 13.5% of the amount of the Adjusted Family Net Income (AFNI) greater than $36,502 up to $79,087.

- If income is greater than $79,087 then the reduction is $5,749 plus 5.7% of the AFNI greater than $79,087.

Three Eligible Children

- The reduction is 19% of the amount of the Adjusted Family Net Income (AFNI) greater than $36,502 up to $79,087.

- If income is greater than $79,087 then the reduction is $7,728 plus 5.7% of the AFNI greater than $79,087.

Four or More Eligible Children

- The reduction is 23% of the amount of the Adjusted Family Net Income (AFNI) greater than $36,502 up to $79,087.

- If income is greater than $79,087 then the reduction is $9,795 plus 5.7% of the AFNI greater than $79,087.

To find out more information on the Canada Child Benefit or CCB, visit the CRA’s website for a CCB calculator and more information via this link: Canada Child Benefit Overview by the CRA.

Provincial Child Care Benefits

While Canada’s Child Care Benefit (CCB) is a nationwide program, provincial governments provide additional support through taxable benefits and cash to help families afford schooling, daycare, transportation, and food. The subsidy is measured on the family’s net income, community of residence, family size, children’s age and provincial resources.

Missing Out on Child Tax Benefits?

Get expert help from a CPA to make sure you’re maximizing your tax deductions.

Alberta Child and Family Benefit (ACFB)

The Alberta Child and Family Benefit (ACFB) assists families with children under the age of 18. Families are automatically assessed when filing their tax return and are entitled to a maximum support of $1,469 for the first child with the benefits reducing for each additional child. While payments are sent separately with the federal portion, ACFB payments are issued in August, November, February, and May.

The BC Family Benefit

The BC Family Benefit (BCFB) offers essential financial support to families with children under the age of 18, helping to ease childcare expenses. Families registered with the federal CCB are automatically registered with the BC childcare program. A notable event is families registered for BCFD between July 2024 – June 2025 as they are eligible for a bonus with their financial support.

The BC child care subsidized a maximum of $182.33 per month for a single child with payments issued monthly with your federal portion. The income threshold to receive the maximum benefit is income less than $35,902. Payments for residents with income between $35,902 and $114,887 are reduced by 4% with families receiving a minimum of $80.75.

Manitoba Child Care Benefits

The province of Manitoba does not administer provincial child care benefits, but residents residing in Manitoba are still eligible for Canada’s Child Care Benefit.

New Brunswick Child Tax Benefit (NBCTB)

The New Brunswick Child Tax Benefit (NBCTB) program supports qualifying families with children under 18 by providing monthly financial assistance alongside federal child benefits. Eligible families can receive up to $250 annually, with additional support available through the New Brunswick Working Income Supplement (NBWIS), which adds $20.83 per month. Low-income households with an adjusted net income below $20,000 may also qualify for the New Brunswick School Supplement, a yearly payment of $100 per child to help with educational expenses.

Newfoundland & Labrador Child Benefit

The Newfoundland & Labrador Child Benefit provides financial support to low-income families providing emergency aid for households with annual income less than $28,500. Families with incomes below $17,397 qualify for the full benefit of $152.16 per child, while those earning between $17,397 and $28,500 receive partial benefits. However, families with children under five years old can access up to $150 per month through a prenatal-early childhood nutrition supplement, enhancing support for early childhood development and nutrition.

Northwest Territories Child Benefit (NWTCB)

The Northwest Territories Child Benefit (NWTCB) recently improved its program in 2017 to provide additional support for rising costs. The benefits are issued monthly with two different age brackets: children with a single child under the age of 6 can receive $815 annually with children between the ages of 6-17 receiving $652. NWTCB are eligible for families with income below $30,000 to receive the full benefits while partial funding is given up to $80,000.

Nunavut Child Benefit (NUCB)

The Nunavut Child Benefit (NUCB) provides low-income families with monthly payments that are administered by CRA. Families must have an adjusted net income of $3,750 to $20,921 from the previous year to qualify for Nunavut child benefits, where families can receive $275 for the first child and $75 for the second child.

Nova Scotia Child Benefit (NSCB)

Nova Scotia Child Benefit (NSCB) was increased in 2023 to offset inflation and rising costs to help families raise their children. Households with adjusted net income below $26,000 are eligible to receive $1,525 annually for each of their children. In addition, families with an income between $26,000 – $34,000 will receive $1,525 for the first children and be reduced by half with the subsequent children. It’s important to note that residents in Nova Scotia are not required to apply but receive payments automatically when their personal income tax is filed.

Ontario Child Benefit (OCB)

The Ontario Child Benefit (OCB) is a monthly payment that is administered by CRA with your federal child care benefit. When applying for the federal childcare benefit, you are automatically assessed to see if your eligible income level is below $25,646. If it is, you’d receive $140 per month in Ontario Child Benefits.

Prince Edward Island Child Benefit (PEICB)

To receive Prince Edward Island Child Benefit (PEICB) residents must either be registered with Canada’s Child Care Benefits or submit a personal income tax return. Qualifying for PEICB subsidies requires families with an adjusted net income of $45,000 or less to receive the maximum benefit of $30 per child or $360 annually. The income levels between $45,000 – $80,0000 are reduced but receive a partial income of $20 per child.

Quebec Family Allowance

The Quebec Family Allowance varies depending on your income bracket. The maximum allowance in this program is $3,006 for families with one child and a net income of less than $59,000. For single parents, there is an additional annual payment of $1,055. Quebec offers additional financial support for families purchasing school supplies, disability support for children, and supplementary financial aid for children requiring exceptional care.

Saskatchewan Employment Incentive (SEI)

In January 2024, Saskatchewan introduced the Saskatchewan Employment Incentive (SEI) program, replacing the Saskatchewan Child Care Subsidy (CCS) to make life more affordable for residents. The SEI program offers a range of benefits, including monthly financial assistance, supplementary health coverage, discounted bus passes, career training, and housing support. Designed to support families with monthly incomes between $500 and $2,200, the program provides a maximum monthly financial allowance of $400–$600 for families with children.

Yukon Child Benefit (YCB)

The Yukon Child Benefit (YCB) is issued monthly by CRA combining provincial and federal cash assistance. The YCB provides a maximum cash benefit of $76.50 per child if your adjusted net income is below 35,000. To be eligible for this program residents of Yukon are required to fill this form.

Are Child Care Benefits Tax Deductible?

In Canada, any income received from the federal and provincial government for childcare benefits is non-taxable. This helps families across Canada to alleviate financial pressure to provide a positive and healthy environment for their children. However, certain expenses possess taxable benefits that you can claim on the upcoming personal income tax deadline. To get you more information on these deadlines, we created a checklist of all the notable changes and exemptions for your income tax returns here.