Canada Tax Filing Deadlines 2024: A Comprehensive Guide

Stepping into the new year, it’s important for everyone across Canada to be aware of the upcoming tax filing deadlines in 2024. At Advanced Tax, we have a deep understanding of tax, bookkeeping, and accounting services, ready to get you through this process. We’ve compiled an overview of the key deadlines that individuals and businesses need to take note of for the upcoming tax season. We do it to ensure you manage your financial responsibilities effectively.

Need to Get Your Canadian Tax Return Filed?

Our accountants are just a click away. Call or send us a message to get ahead of your taxes.

Personal Tax Filing Deadlines

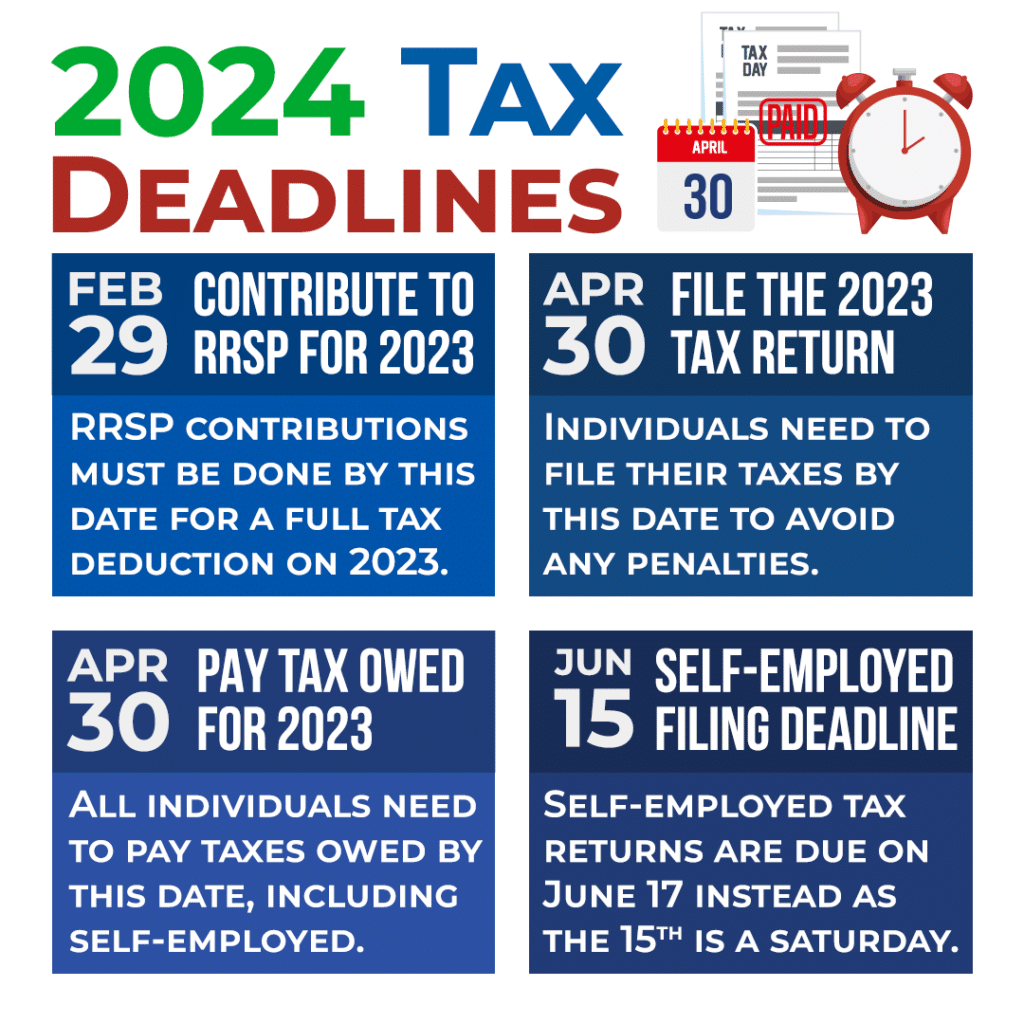

2023 RRSP Contribution

You have until February 29, 2024, to contribute to your RRSP for the 2023 tax year. RRSP contributions are fully tax-deductible. They reduce taxable income dollar-for-dollar until the assigned deduction limit. The RRSP deduction limit is either the lesser of 18% of the previous year’s income or the CRA’s annual limit.

Income Tax Return Filing

The deadline for filing income tax returns for individuals is April 30, 2024. Self-employed individuals get an extended deadline until June 17, 2024. This is due to the usual June 15 deadline falling on a Saturday. Tax payments, including those for self-employed individuals, are due by April 30, 2024.

Deceased Taxpayers

For anyone who has passed away between January and the end of October 2023, the filing deadline for the year of death is April 30, 2024. If the death occurred in November or December 2023, the deadline is six months from the date of death. Outstanding taxes would be due on their respective filing dates.

RRSP Conversion

Turning 71 in 2024 requires converting your RRSP to a registered retirement income fund (RRIF) or a life annuity by December 31, 2024. Plan this conversion in early December to make sure your financial plans aren’t affected by it.

Underused Housing Tax Filing Deadlines

Owners of residential property that are affected by the Underused Housing Tax (UHT) need to file their UHT return for the 2022 calendar year by April 30, 2024. The payment needs to be completed by this date as well to avoid penalties or interest.

Business Tax Filing Deadlines

T4 Employment-Income Slips

Businesses need to send out T4 employment-income slips by February 29, 2024. These slips are used for reporting different remuneration types, such as salary, wages, bonuses, and taxable benefits. Filing a T4 slip is mandatory if pension adjustments, CPP, QPP contributions, EI premiums, or income tax deductions were applied, or if the remuneration exceeds 0. Find out more information on filing the T4 slip and summary forms from the CRA’s website at this link.

T4A Forms

Businesses making payments like pensions, lump-sum payments, annuities, or other income, including fees or commissions to non-residents, should file T4A forms by February 29, 2024. Reporting taxable group term life insurance benefits on T4A slips is obligatory if the amount surpasses .

T5 Forms

To report investment incomes in Canada, T5 forms need to be filed. They are due by February 29, 2024. It’s important to note that T5 slips should not be used for reporting investment income paid to non-residents.

Utilizing the Canadian Tax Filing Deadlines for 2024

At Advanced Tax, we understand the importance of meeting these deadlines. Not only is this key for compliance with Canadian tax regulations, but it lets us help you save on your taxes. Our team is committed to assisting you with your tax, bookkeeping, and accounting needs. Feel free to reach out to us for personalized assistance on your tax journey. Remember, staying informed is the first step towards financial success.