Highlights from the Canada Federal Budget 2023

On March 28, 2023, the Deputy Prime Minsiter and Minister of Finance delivered the 2023 Federal Budget. Named the “A Made-In-Canada Plan”, this budget emphasizes economic growth, public healthcare, and incentives for businesses to pursue clean energy. Read about some of the notable highlights here.

Proposals to Employee Ownership Trusts by the Federal Budget

An Employee Ownership Trust (EOT) is used to facilitate the purchase of a business by its employees. It doesn’t need them to pay the business owner directly and is an option for succession planning. The 2023 federal budget puts out new rules that are effective as of January 1, 2024.

The main proposals of the budget include extending the five-year capital gains reserve to a 10-year reserve for qualifying business transfers into the EOT with a minimum of 10 percent of the gain being brought in annually. Additionally, taxpayers receiving a shareholder loan from the corporation would have an exception to extend the repayment period from 1 to 15 years for amounts loaned to the EOT to purchase shares. Finally, an exemption to EOTs from the 21-year rule of disposing capital property has been proposed.

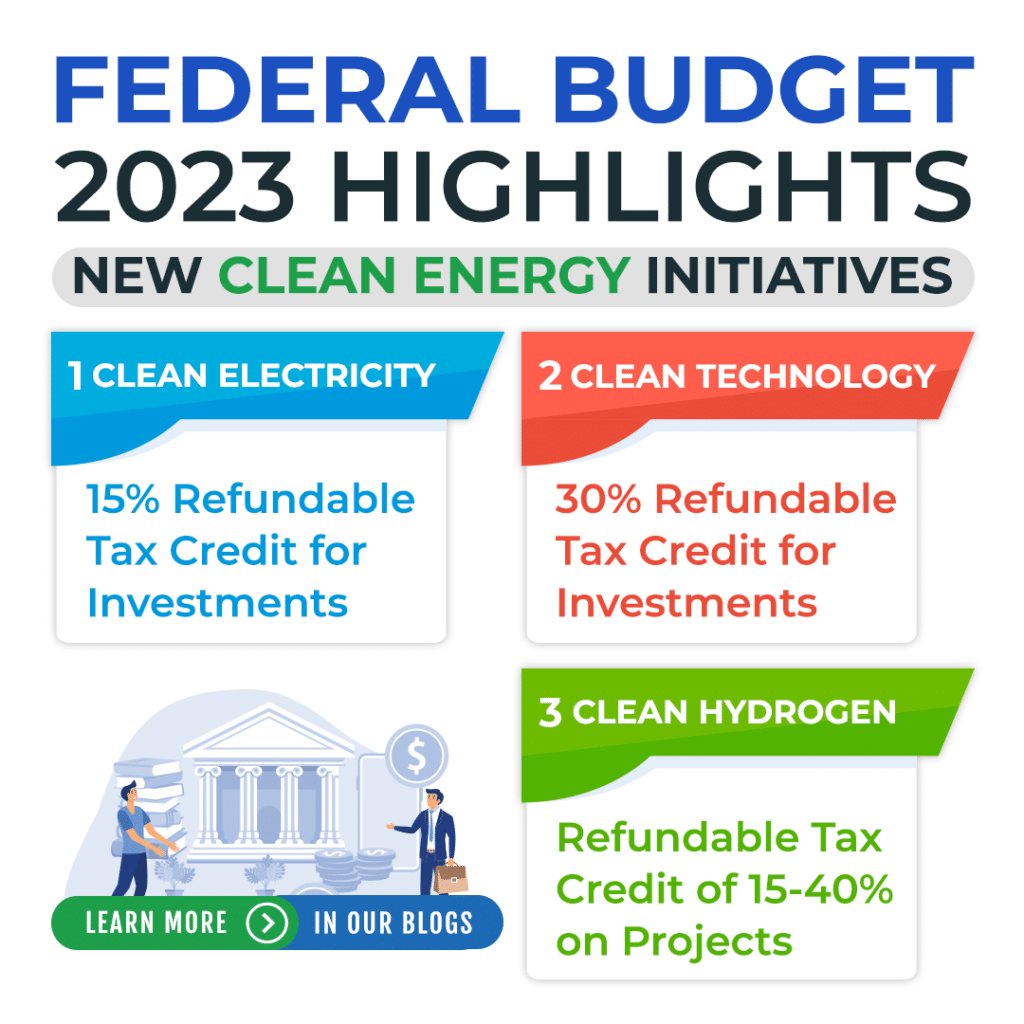

Federal Budget Clean Energy Incentives

Clean Electricity Investment Tax Credit

This is a 15% refundable tax credit for investments in specific activities to generate electricity and equipment for transmitting it between provinces. New projects and the refurbishment of existing ones are eligible but will not be available after 2034.

Clean Technology Manufacturing Credit

A 30% refundable tax credit will be offered for the cost of investments in new machinery and equipment. It must be used to manufacture or process certain clean technologies and extract, process or recycle certain critical materials.

The credit applies to property acquired and available for use after January 1, 2024 but will be phased out between 2032 and 2034. It will also include geothermal systems that are eligible for capital cost allowance (CCA).

Clean Hydrogen Investment Tax Credit

This is a refundable tax credit between 15 and 40 percent for eligible project costs in producing clean hydrogen. It also comes with a 15 percent tax credit for specific equipment.

Reduced Rates for Zero-Emission Technology Manufacturers

Reduced tax rates of 4.5 and 7.5 percent for zero-emission technology manufacturers is proposed to be extended by 3 years to 2034, but will start phasing out in 2032. It will also include manufacturing nuclear energy equipment and processing and recycling nuclear fuels and heavy water.

Proposed Personal Tax Measures in the Federal Budget

Alternative Minimum Tax

The federal budget 2023 proposed an amendment to the Alternative Minimum Tax (AMT) for individuals. It is a flat 15 percent tax based on individual income with an assumption of a ,000 exemption. What it does is that it allows less deductions, exemptions, and tax credits that would usually be applicable under regular tax rules. It applies when the 15 percent tax is greater than the tax calculated when all deductions, exemptions, and credits are allowed. The proposal expands the AMT by limiting tax preferences in the calculation which are as follows:

- Inclusion rate of capital gains increased from 80% to 100%. Capital losses and allowable business investment losses apply at a 50% rate.

- The inclusion rate for benefits associated with employee stock options will be 100%.

- Inclusion rate for capital gains from donation of publicly listed securities will be changed to 30%.

- Certain deductions and expenses will be limited to 50%.

- Only 50% of non-refundable tax credits will be allowed to reduce the AMT.

- The AMT tax rate will increase from 15% to 20.5%.

- The exemption will increase from the current allowable deduction of $40,000 for individuals to an amount indexed in the fourth tax bracket. This is estimated to be $173,000 in 2024.

- These new rules will come into force for taxation years after 2023.

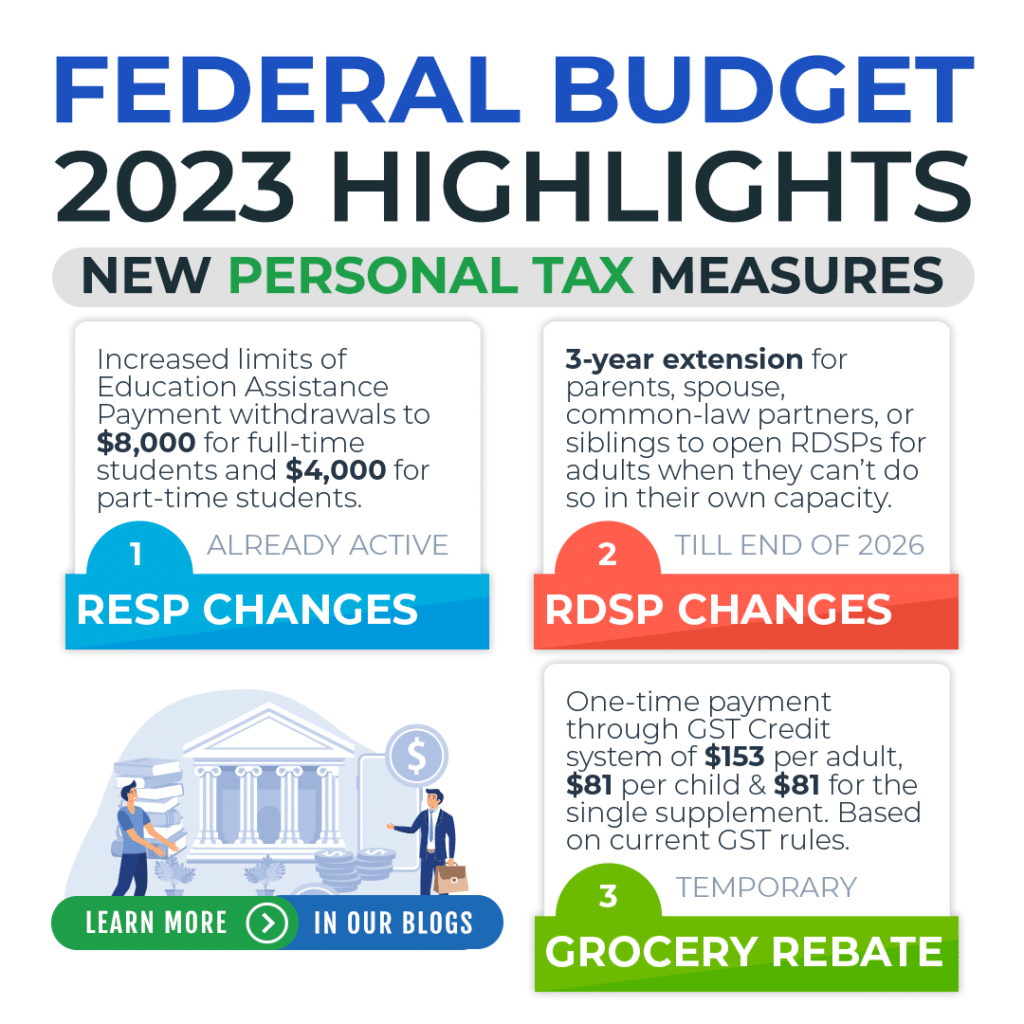

Improvements to the Registered Education Savings Plans (RESP)

The 2023 Federal Budget proposed an increase to the limits of Education Assistance Payment withdrawals from RESPs. This limit is to increase from $5,000 to $8,000 for full-time students and from $2,500 to $4,000 for part-time students. Divorced or separated parents will also be able to open a joint RESP for their children.

Federal Budget Changes to Registered Disability Savings Plans (RDSP)

A 3-year extension of temporary measures that allow qualifying family members to open RDSPs for adults who can’t do so in their own capacity and don’t have a legal representative.

Qualifying family members include parents, spouses, common-law partners, or siblings and will remain active until December 31, 2026.

Grocery Rebate

2023’s federal budget brings forth the Grocery Rebate. This one-time payment is administered through the Goods and Services Tax Credit (GSTC) system. Maximum amounts are $153 per adult, $81 per child, and $81 for the single supplement. It will be phased in and out as per the same income levels that are considered by current GSTC rules.

If you would like to read about the full budget, just click on the link here to access the downloadable on CRA’s website. Contact us to find out how the new federal budget will affect your taxes through email, phone, or by visiting our office in Richmond, BC.