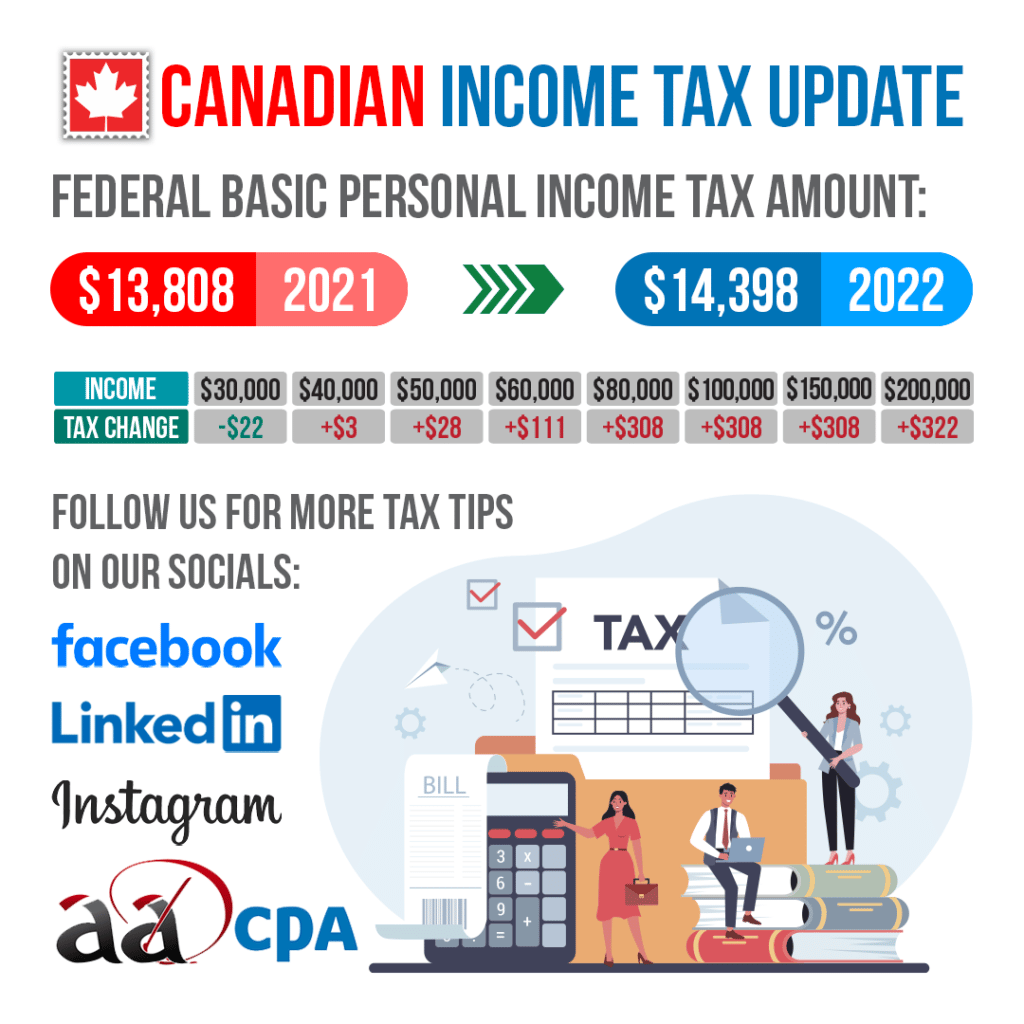

Besides payroll taxes, the federal income tax that will be paid in 2022 would be generally lower. This is because the federal basic personal amount is now increasing from $13,808 to $14,398.

Basically that means if you are making less than $155,625, you’ll be eligible to claim an additional $590 in tax-free income compared to previous years. This will save around $89 in income taxes.

We’ve listed out the changes to each tax bracket below but if you are earning ,000 or less, you will see some tax savings. As for everyone else above that threshold, here’s what your changes will look like.

For further details, make sure you keep updated on the official Canadian tax website at Canada.ca.

To summarize, almost every income level will be paying more taxes as long as you make ,000 or less. Otherwise as shown by the table above, anyone earning more than that will have a higher tax bill. This is also affected by changes to their Canada Pension Plan and Employment Insurance taxes.

Questions? Call or send us an email so we can get started on helping you get ready for your tax filing.