Key Changes to Tax Numbers for the 2024 Tax Year

The year is coming to an end, and we are getting ready for the 2024 tax season. The upcoming year brings changes across the board regarding income tax, pension amounts, benefits for dependants, and the tax brackets themselves. Keep the following list of tax numbers as a reference for the upcoming year to make sure that you’re making the most out of your taxes.

Indexation Increase for 2024 Tax Numbers

Every year’s amounts for specific personal income tax and benefits are indexed to inflation. This is based on the Consumer Price Index data that is reported by Statistics Canada. Most amounts are affected on January 1 of the relevant year. The goods and services tax credit, Canada child benefit, and Child disability benefit come into effect on July 1. This is to align with the beginning of the program year for payments of the benefits. The indexation increases for 2024 are at 4.7% and here are some key places it takes effect.

Get Expert Advice on What These Numbers Mean

Get in touch with our tax experts today to find out how they affect your tax filing.

Updated Tax Bracket Thresholds for 2024

Above these amounts are the incomes at which the relevant federal tax brackets begin:

| Bracket | 2023 Amount | 2024 Amount |

| 20.5% | $53,359 | $55,867 |

| 26% | $106,717 | $111,733 |

| 29% | $165,430 | $173,205 |

| 33% | $235,675 | $246,752 |

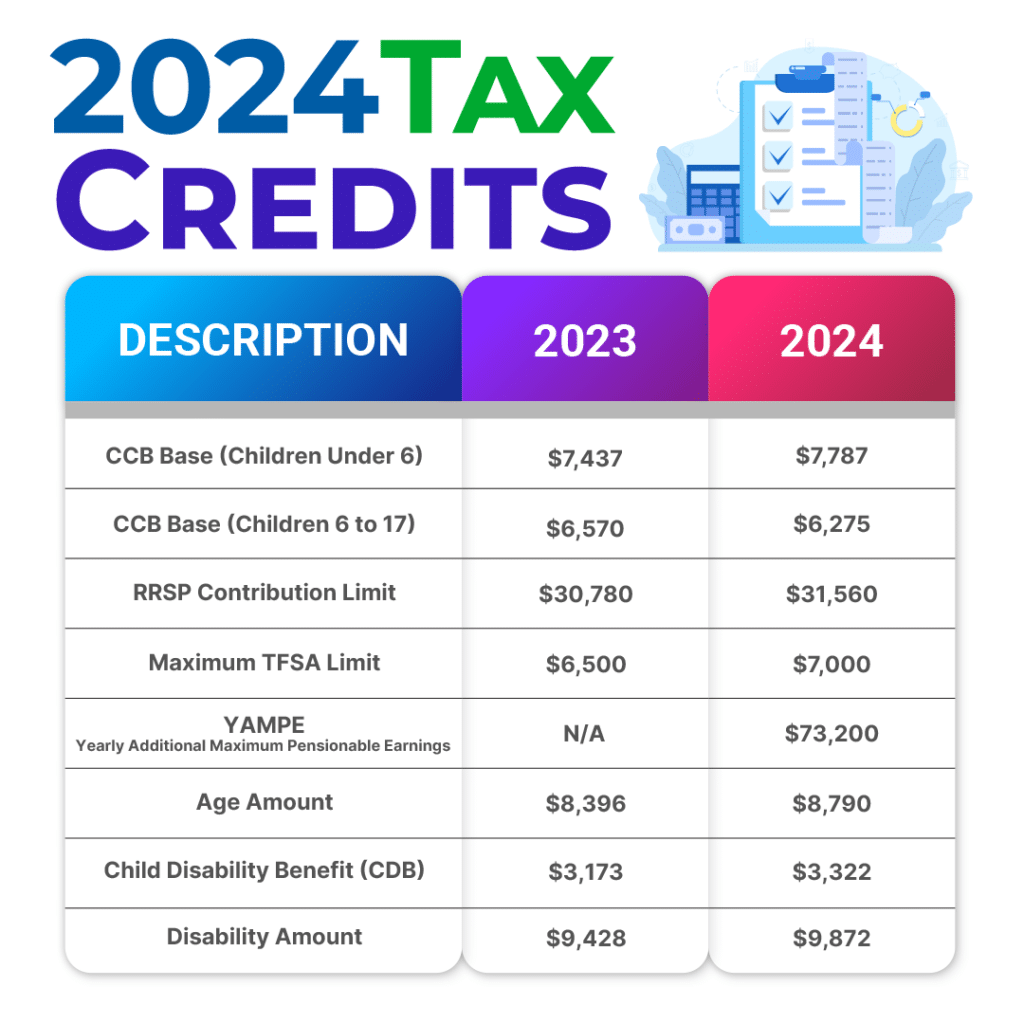

Updated 2024 Tax Amounts for Dependants

The indexation increase has affected a credits, amounts, and benefits for those with children or other dependents. Here are the key amounts to consider:

| Description | 2023 Amount | 2024 Amount |

| Canada Caregiver Amount for Children Under 18 | $2,499 | $2,616 |

| Canada Caregiver Amount for Other Infirm Depends 18 or Over | $7,999 | $8,375 |

| Canada Child Benefit (CCB) (Base Benefit for Children Under 6) | $7,437 | $7,787 |

| Canada Child Benefit (CCB) (Base Benefit for Children from 6 to 17) | $6,570 | $6,275 |

| Child Disability Benefit (CDB) | $3,173 | $3,322 |

| Disability Amount | $9,428 | $9,872 |

New Tax Numbers for Seniors in 2024

Aging citizens have the following updated tax numbers to consider:

| Description | 2023 Amount | 2024 Amount |

| Age Amount (Claimed by People Aged 65 or Older) | $8,396 | $8,790 |

| Lifetime Advanced Life Deferred Annuities (ALDA) Dollar Limit1 | $160,000 | $170,000 |

| Old Age Security (OAS) Repayment Threshold2 | $86,912 | $90,997 |

1An ALDA is a life annuity in which the annuity payment must be started before the year end of the year that the taxpayer turns 85.

2If net income exceeds the amounts, part or the entire OAS pension must be repaid.

Other Important Tax Numbers for Taxpayers to Consider in 2024

For any taxpayer in Canada, there are several updates to tax numbers that need to be referred to when filing the 2023 income tax return or planning for the 2024 tax year. These limits, exemptions, and amounts will directly affect your 2023 and 2024 tax returns. Here are some relevant numbers to consider:

| Description | 2023 Amount | 2024 Amount |

| Registered Retirement Savings Plan (RRSP) Contribution Limit | $30,780 | $31,560 |

| Maximum TFSA Limit | $6,500 | $7,000 |

| Yearly Maximum Pensionable Earnings (YMPE) | $66,600 | $68,500 |

| Yearly Additional Maximum Pensionable Earnings (YAMPE)3 | N/A | $73,200 |

| Maximum EI Insurable Earnings4 | $61,500 | $63,200 |

| Lifetime Capital Gains Exemption | $971,190 | $1,016,836 |

| Home Buyers’ Amount | $10,000 | $10,000 |

| Home Buyers’ Non-Refundable Tax Credit | $1,500 | $1,500 |

| Basic Personal Amount for Net Incomes Under the 33% Tax Bracket | $15,000 | $15,705 |

| Basic Personal Amount for Net Incomes in the 33% Tax Bracket | $13,520 | $14,156 |

3As of January 1, 2024, there will be a second earnings ceiling to maximum pensionable earnings called the YAMPE. It is around 7% higher than the initial earnings ceiling (YMPE). The calculation is based on a percentage of wages between the YMPE and YAMPE amounts. Employees contribute 4% of what they earn while self-employed individuals contribute 8%.

4The EI premium rate has increased by 3% from .63 to .66 per 0 of insurable earnings for employees and from .28 to .32 for employers. This is due to the forecasted cumulative deficit in the EI Operating Account from the COVID-19 pandemic. It is estimated that the account will come to a near cumulative balance by 2030.

What Do the Tax Numbers Mean for Your Personal Income Tax Return?

As we get closer to the filing deadlines for the 2023 personal tax returns, it is important for every taxpayer to be planning their taxes for the upcoming year. This affects many financial decisions Canadian taxpayers make, from buying a home or contributing to their RRSP. Reading through your tax return may leave more questions than answers, but that’s why we’re here to help. Get ahead of your 2023 tax return by contacting us today. Our expert tax accountants help you make the most of it and give you the advice you need to prepare for the 2024 tax year and maximize your savings.