A Detailed Look at Cash vs Accrual Accounting in Canada

In the dynamic landscape of Canadian business, maintaining precise financial records is crucial for long-term success. A pivotal decision that Canadian business owners often face is selecting between the cash and accrual accounting methods. In this blog post, our seasoned CPA accounting firm will delve into the intricacies of cash vs accrual accounting in Canada, empowering you to make informed choices for your business.

Cash vs Accrual Accounting: An Overview

Understanding Cash vs Accrual Accounting

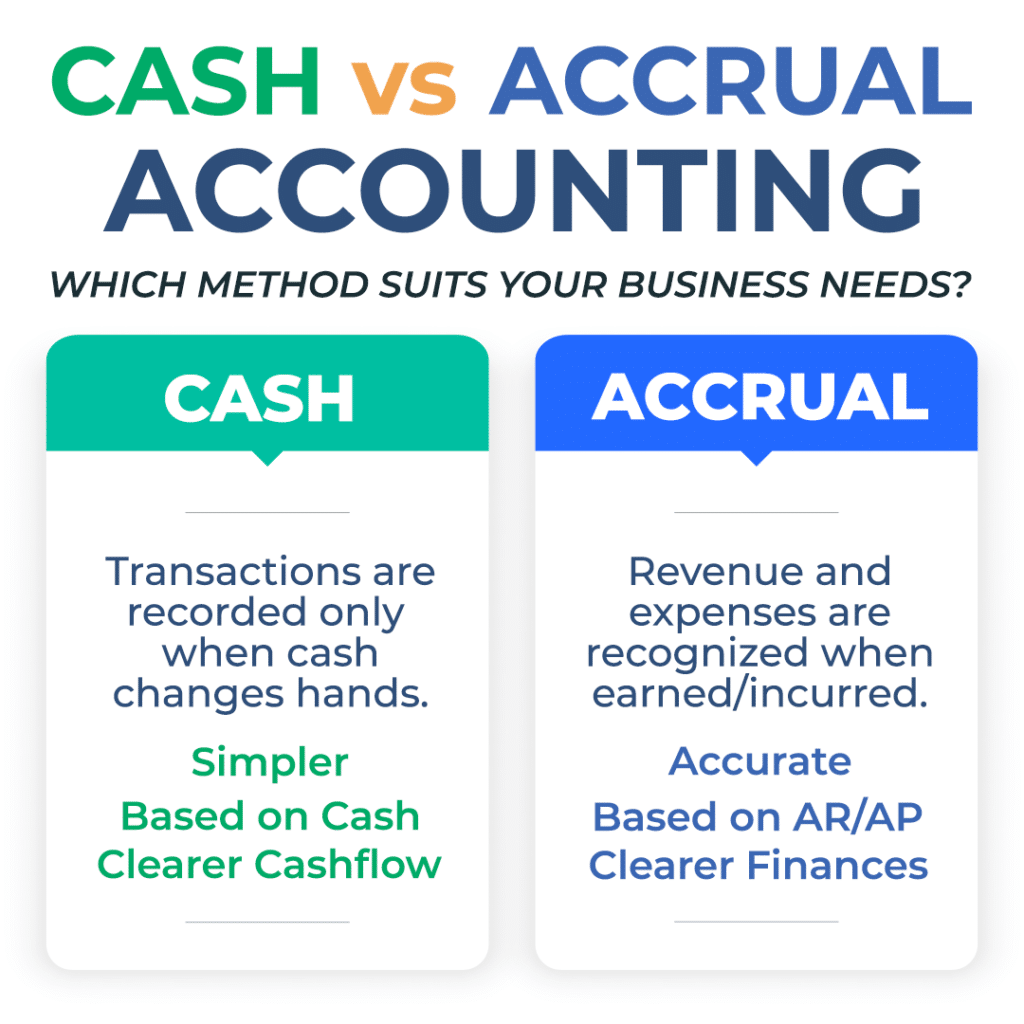

Cash vs accrual accounting denotes two distinct approaches for recording financial transactions within your business. These methods diverge in how they recognize revenue and expenses:

- Cash-Based Accounting: Under this method, transactions are recorded exclusively when cash changes hands. Revenue is acknowledged upon receipt of payment, and expenses are logged when cash disbursements occur.

- Accrual-Based Accounting: In contrast, accrual accounting recognizes revenue when it is earned and expenses when they are incurred, irrespective of the timing of actual cash inflows or outflows.

Cash vs Accrual Accounting for Small Businesses

While making this pivotal choice, it’s vital to consider the size and operations of your business. Here are some of the advantages of using cash vs accrual accounting for a small business.

- Simplicity: Cash accounting offers a simpler system, making it suitable for small businesses with straightforward financial transactions.

- Cash Flow Management: It delivers a clear view of cash flow, which can be advantageous for businesses where cash flow management is paramount.

- Tax Flexibility: Small businesses in Canada, with annual revenues under $500,000, have the option to choose cash accounting for tax purposes, providing flexibility in income reporting.

Varieties of Accounting: Accrual vs Cash

- Accrual Accounting: This method offers a more precise depiction of a business’s financial health as it considers accounts receivable and accounts payable. It is often favored by larger businesses or those with intricate financial transactions.

- Cash Accounting: Cash accounting is ideal for businesses seeking simplicity and a focus on tracking financial performance based on cash flow. It is frequently employed by small businesses, sole proprietors, and partnerships with minimal financial complexity.

Accounting Method: Accrual vs Cash

Your selection of an accounting method can significantly impact financial statements, tax liabilities, and decision-making. Here’s how each method affects crucial financial aspects.

| Accrual Accounting | Cash Accounting | |

| Financial Statements | Offers a more accurate representation of your business’s financial health, encompassing accounts receivable and accounts payable. | Simplifies financial statements by solely accounting for actual cash transactions. |

| Tax Reporting | Might lead to higher taxes since income is recognized when earned, irrespective of cash receipt. | Typically results in lower taxes as income is recognized when cash is received, and expenses are deducted when cash payments are made. |

| Decision-Making | Enables more informed decision-making by providing a comprehensive view of your financial performance. | Provides a simplified view, which may be suitable for businesses focused on immediate cash management. |

Making the Right Choice

Ultimately, the decision between cash and accrual accounting in Canada should align with your business’s size, complexity, and financial goals. Many small businesses opt for cash accounting for its simplicity, while larger enterprises often favor accrual accounting for its precision.

Our accounting professionals at Advanced Tax have a deep understanding of the value in using cash vs accrual accounting methods at your business. We can assist you in making the choice between which one is more suited to your business. Whether you need support with tax planning, financial statements, or general accounting services, our team is ready to guide you to your financial success.

In conclusion, the choice between cash and accrual accounting holds significant implications for Canadian business owners. Being experts on the distinctions, advantages, and consequences of each method lets our team help you make informed decisions. This is key for your business to grow on a path of financial prosperity. If you have any questions and would like to an expert, reach out to our CPA firm.