Mastering Depreciation: Canadian Business Owners’ Guide to Depreciation Methods

In the realm of accounting, having a comprehensive grasp of depreciation is indispensable for Canadian business proprietors. Depreciation significantly influences financial reporting and tax planning, impacting both the balance sheet and income statement. To make well-informed decisions about managing your enterprise’s assets and financials, it’s imperative to comprehend the various depreciation methods, the process of calculating depreciation, and the purpose.

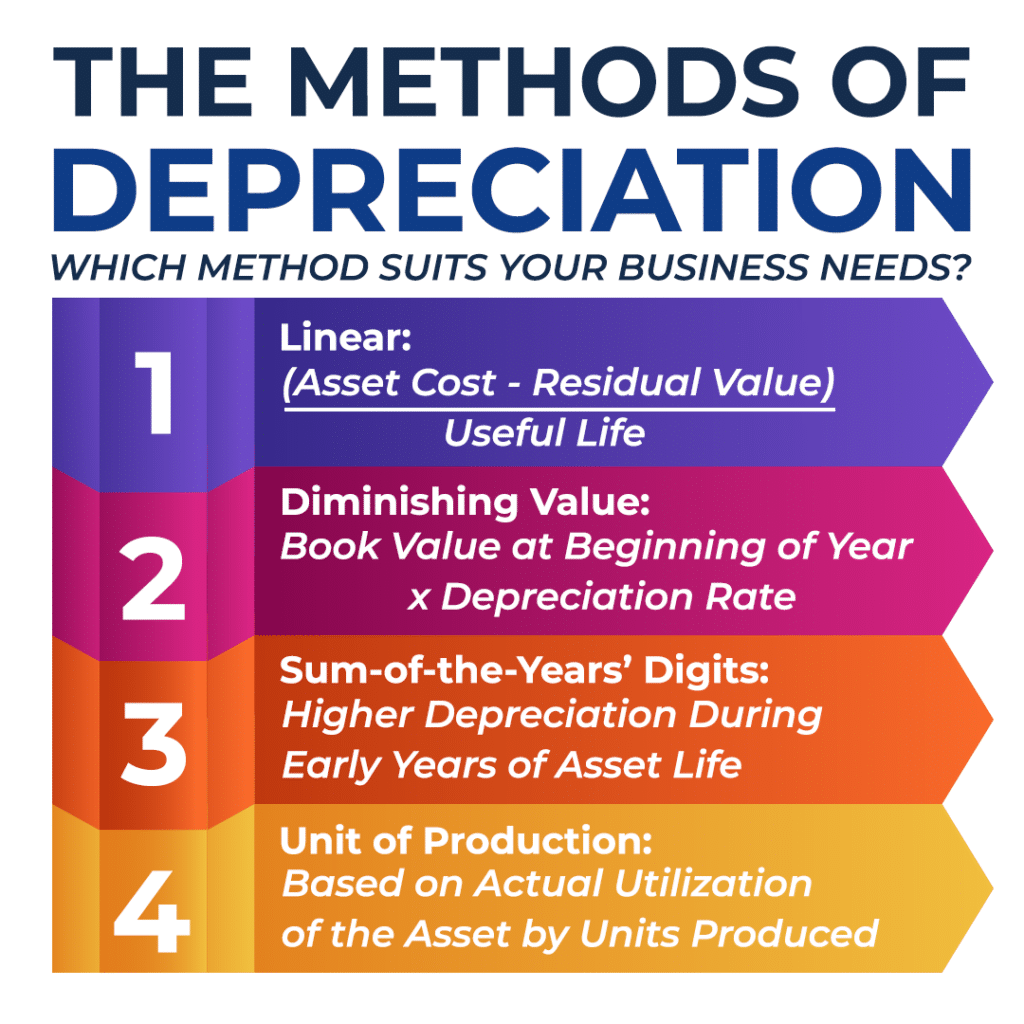

Depreciation Methods

Depreciation in the sphere of accounting entails the systematic allocation of a tangible asset’s cost over its expected utility period. It serves as a reflection of the asset’s gradual wear and tear as it contributes to revenue generation. There exist multiple methodologies for depreciation in Canada, each characterized by unique attributes. Let’s explore the most prevalent ones:

Linear Depreciation

Linear depreciation is the most straightforward technique, spreading the depreciable amount of an asset evenly over its anticipated service life. The formula for computing linear depreciation is as follows:

Depreciation Expense = (Asset Cost − Residual Value) / Useful Life

This approach is frequently favored for its simplicity and equitable distribution of depreciation expenditures over time.

Diminishing Value Depreciation

The diminishing value method, also known as the double-declining balance, results in higher depreciation expenses during the initial years of an asset’s existence. It is particularly advantageous for assets that depreciate swiftly. The formula for diminishing value depreciation is as follows:

Depreciation Expense = Book Value at the Beginning of the Year × Depreciation Rate

The depreciation rate is generally twice the linear rate. This methodology permits accelerated write-offs during the initial years of an asset’s utilization.

Sum-of-the-Years’ Digits

The sum-of-the-years’ digits technique strikes a balance between the linear and diminishing value methods. It assigns more depreciation during the early years of an asset’s life, albeit not as aggressively as the double-declining balance. The formula for this method may be somewhat intricate but offers a flexible approach to asset depreciation.

Unit of Production

This methodology calculates depreciation based on the actual utilization of the asset. It is notably beneficial for businesses with fluctuating production levels from year to year. The formula depends on the specific units produced or consumed.

The Purpose of Depreciation Methods

Depreciation is not just a procedural accounting requirement; it fulfills several pivotal objectives for Canadian businesses:

- Accurate Financial Statements: Depreciation guarantees that a company’s financial statements accurately depict the depreciation of asset values over time. This holds substantial significance for stakeholders and investors.

- Tax Advantages: Depreciation enables businesses to claim deductions on their income tax returns, subsequently decreasing their taxable income. This can lead to substantial tax benefits.

- Asset Management: It aids businesses in making informed decisions regarding asset replacement, upgrades, sales, or retirements.

- Budgeting: By forecasting future depreciation expenses, businesses can engage in effective budgeting and resource allocation.

Depreciation Methods Rates

Depreciation rates in Canada fluctuate contingent upon the asset type. The Canada Revenue Agency (CRA) issues guidelines to ascertain these rates. It is imperative to reference these rates when computing depreciation for tax-related purposes. Accurate depreciation calculations and adherence to the prescribed rates can result in considerable tax advantages.

In conclusion, an understanding of diverse depreciation methods is indispensable for Canadian business owners and managers. Whether opting for linear depreciation for its simplicity, diminishing value for swifter depreciation, or another strategy, the chosen approach impacts financial statements, taxation, and overall fiscal well-being.

Should you require assistance with depreciation calculations, method selection, or any other tax and accounting services, our CPA firm is at your service. We specialize in providing expert guidance to Canadian enterprises navigating the complexities of depreciation and other financial matters. Please do not hesitate to reach out for seasoned advice and support.

Keep in mind that precise depreciation accounting is not solely a financial best practice; it also serves as a strategic tool for optimizing your business’s financial performance.