Diving into the Underused Housing Tax: A Comprehensive Guide for Canadians

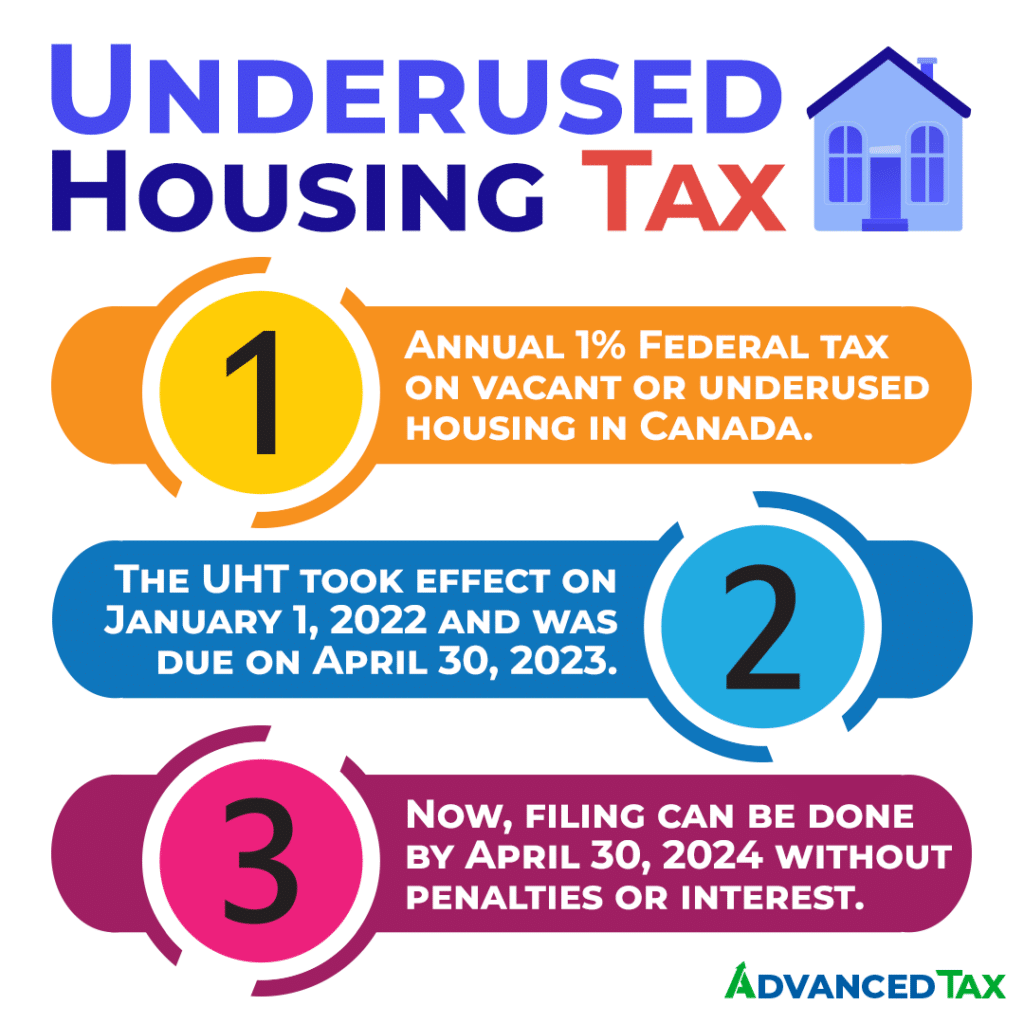

In the realm of Canadian taxation, the Underused Housing Tax (UHT) is a topic that has been getting increased attention. There have been some important updates that you may need to know about this tax act that were announced recently. These changes affect residential property owners for those with vacant or underused housing in Canada and took effect on January 1, 2022. Continue reading to learn about the recent changes on the UHT.

Making Sense of the Underused Housing Tax Act

To start, here’s what the underused housing tax even refers to. It’s a federal move to encourage homeowners in Canada to make better use of their residential properties. It is also known to some as the vacant home tax. The purpose of the Underused Housing Tax Act was to push homeowners to contribute to a more efficient and fair housing market.

In specific, the Underused Housing Tax is an annual federal tax of 1% on the ownership of vacant or underused housing in Canada. Certain provinces and municipal governments may have additional vacancy taxes. In general, they apply to foreign national homeowners. Find out more on whether the federal underused housing tax applies to you by clicking here.

British Columbia’s Speculation and Vacancy Tax

For owners of residential properties in certain areas of the province of British Columbia, another vacancy tax may affect you. All registered owners of residential property in specific taxable areas must complete a declaration by March 31 every year. This is to declare their residency status and how the property was used. The tax rates as of 2019 and subsequent years are as follows:

- 2% for foreign owners and satellite families.

- 0.5% for Canadian citizens or permanent residents of Canada who are not members of a satellite family.

If the property has multiple owners, the tax amount owed is divided based on each owner’s share. Corporations, trustees, and business partners have additional considerations. Information for these types of owners can be found here. To find out if it applies to you, see the interactive map by the Province of British Columbia by clicking on this link.

The Good News: An Extended Filing Deadline on the Underused Housing Tax

As of October 2023, owners impacted by the Underused Housing Tax have received a welcomed change. The transitional relief period, originally set to expire, has been extended until April 30, 2024. This extension provides affected homeowners with additional time to ensure compliance with the Underused Housing Tax regulations without incurring penalties or interest.

This extension is particularly significant for those who need to file their Underused Housing Tax returns for the 2022 calendar year. The grace period until April 30, 2024, offers a valuable window for property owners to gather necessary documentation, understand the regulations, and fulfill their tax obligations without worrying about penalties or interest.

Key Exemptions and Regulations

While the Underused Housing Tax aims to address underutilized properties, there are certain exemptions that homeowners should be aware of. Understanding these exemptions can make the filing process smoother and help homeowners navigate the regulations more effectively.

If your property is vacant for a legitimate reason – renovations, exceptional circumstances, or other valid reasons, your property can qualify for the exemption under the Underused Housing Act. Talk to your accountant today to find out more on whether your property is exempt or not.

Filing Made Easy: A Quick How-To Guide

At our tax firm, we believe in simplifying processes that may seem complex. Here’s some guidance on how to navigate the Underused Housing Tax filing process. Our brief, step-by-step guide is here to assist any affected homeowners.

- Gather Documentation: Collect all relevant documents, including property records, occupancy details, and any supporting evidence for exemptions.

- Review Exemptions: Evaluate whether your property qualifies for any exemptions under the Underused Housing Tax Act.

- Access Online Resources: Visit the official Canada Revenue Agency (CRA) website for detailed information on the Underused Housing Tax, filing requirements, and available resources.

- File Electronically: Utilize the electronic filing options provided by the CRA for a seamless and efficient submission of your Underused Housing Tax return.

Follow these steps and leverage your available resources to deal with the Underused Housing Tax filing process with confidence. If you need support, just let us know. We’re your partners in the tax journey and are always here to help. Just give us a call to let us help you meet your tax obligations through compliance and timeliness. We can answer any further questions you may have on the complexities of the Underused Housing Tax and get you updates that you could be missing. Working with our CPA’s gives you peace of mind from your taxes to let you focus on what’s important to you.