Guide to Using an RESP in Canada

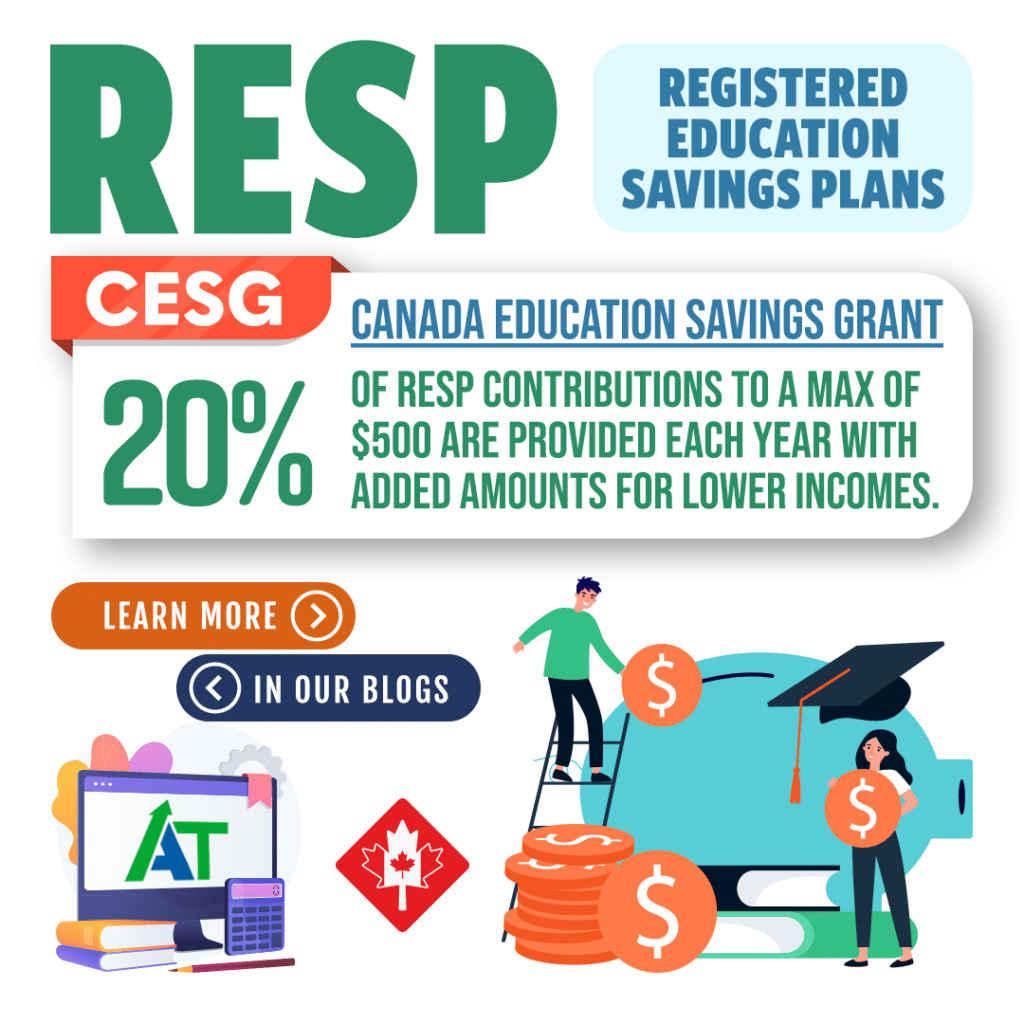

The RESP is a registered savings account for people who want to save for a child’s education after high school. Anyone can open an RESP account for a child, including parents, guardians, grandparents, other relatives or friends. The Registered Education Savings Plan earns interest that is tax-free. It also gets government grants called CESGs.

Time Limits on the RESP

Contributions can be made to an RESP for up to 31 years after it is first opened. At this point, it needs to be transferred into another plan. The funds need to be used before the end of the 35th year to prevent it from expiring.

If an RESP closes or expires before the funds are used, all money received from either the CESG or CLB will be returned to the government of Canada. The CESG is the Canada Education Savings Grant and the CLB is the Canada Learning Bond. All personal contributions and savings in the account would then be returned to the individual who opened the plan.

To keep the interest earned on personal savings, government grants, and bonds, all items in the following criteria must apply:

- All of the children named in the plan are at least 21 years old.

- They must not be eligible for an Educational Assistance Payment.

- The subscriber is a Canadian resident.

- The RESP was opened at least 10 years ago.

This withdrawn money is labeled as an Accumulated Income Payment. It is also taxed at your regular income tax rate with another 20 percent on top. Alternatively, it can be transferred into your or your spouse’s RRSP (Registered Retirement Savings Plan).

How Much Does the Government Provide in an RRSP?

The government matches contributions to an RESP at a rate of 20% per year. This caps out at $2,500 in contributions which means that the maximum CESG grant is $500 per year.

If a child comes from a middle or low-income family, they could be eligible for the Additional amount of CESG. This adds an extra 10% or 20% to the first $500 contributed per year.

If the family’s adjusted income for 2022 is ,197 or less, the additional amount is up to 0. For those with an adjusted income that is between $50,197 and $100,392 – the additional amount is up to $50.

| Adjusted Income for 2022 | CESG Rate | Maximum CESG | Additional CESG Rate | Maximum Additional CESG |

| $0 – $50,197 | 20% | $500 | 20% | $100 |

| $50,197 – $100,392 | 20% | $500 | 10% | $50 |

| $100,392 + | 20% | $500 | 0% | $0 |

The CESG amounts carry forward if unused in a year but the maximum CESG that can be received in a year including the carry forward room is $1000.

Over-Contributing to an RESP

If the total contributions made to a single beneficiary exceeds the lifetime limit of $50,000, tax will be owed. This tax is calculated at the rate of one percent per month on your share of the over-contribution until it is withdrawn. Withdrawals made to eliminate over-contributions do not need a repayment of the CESG unless the total over-contribution is over $4,000.

Learn more about how to manage your RESP accounts by contacting us or visiting the CRA’s guide to RESPs here.